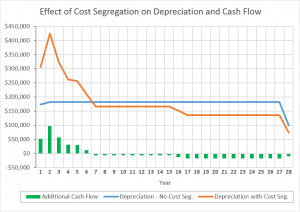

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. CVP is a budgeting process that can be used to establish the break-even point and the expected operating income of the business. For these reasons, and as mentioned earlier, both the P/V graph and break-even chart are used alongside one another by financial managers. However, a major disadvantage is that the graph does not clearly reveal how costs vary with changes in activity. The P/V graph is a simple and convenient way to show the extent to which profits are affected by changes in the factors that affect profit. The data used to prepare the break-even chart, as shown above, have also been used to prepare the P/V graph shown below.

The difficulty in creating treemaps involves selecting appropriate nesting and color-coding schemes to ensure clarity. Treemaps are a space-filling visualization technique that uses nested rectangles to represent hierarchical data. This chart plots statistical distributions by showing the median, quartiles, extremes and outliers of the dataset. A heat map uses color coding to represent values and the density of data points in a table or matrix format.

Examples of Graphs in Practice

An advantage of the P/V graph is that profit and losses at any point can be read directly from the vertical axis. Conversely, the distance between these two lines to the right of the break-even point represents the net profit for the period. To give an example, consider how the data in the table below have been used to create the break-even chart. Back when we did everything on paper, or if you’re using a system like Excel for your bookkeeping and accounting, you used to have to pick and organize these numbers yourself. But because most excel bookkeeping templates accounting software these days will generate these for you automatically, you don’t have to worry about selecting reference numbers.

What does the break-even analysis show?

An easy way to explain this is to translate it into personal finance terms. When you log into your bank, typically you’ll get a dashboard that lists the different accounts you have—checking, savings, a credit card—and the balances in each. Every time you record a business transaction—a new bank loan, an invoice from one of your clients, a laptop for the office—you have to record it in the right account. Below, we’ll go over what the accounting chart of accounts is, leveraged finance levfin what it looks like, and why it’s so important for your business. Bar charts are ideal for showing money amounts, such as revenue, expenses, or profits, across different categories. Every time you add or remove an account from your business, it’s important to record it in your books and your chart of accounts (COA) helps you do that.

But with so many types of visuals available, it can be difficult to know which is the best fit for your needs. Find out more about how QuickBooks Online can help you save time and stay on top of your finances while you grow your business. Ask a question about your financial situation providing as much detail as possible.

- She would then make an adjusting entry to move all of the plaster expenses she already had recorded in the “Lab Supplies” expenses account into the new “Plaster” expenses account.

- Revenue accounts keep track of any income your business brings in from the sale of goods, services or rent.

- To view your chart of accounts, go to Settings and select Chart of accounts (Take me there).

- Find out more about how QuickBooks Online can help you save time and stay on top of your finances while you grow your business.

- And, since the charts depend on your data from GP, they will always be up to date.

- In fact, for 78% of finance professionals, it is a prerequisite for deliverables to comply with their graphic charter.

Do you own a business?

A chart of accounts (COA) is an index of all of the financial accounts in a company’s general ledger. In short, it is an organizational tool that lists by category and line item all of the financial transactions that a company conducted during a specific accounting period. You’ll notice that each account in the chart of accounts for Doris Orthodontics also has a five-digit reference number preceding it.

QuickBooks Online automatically sets up a few of the same standard accounts in the chart of accounts and then gives you additional accounts automatically based on your business entity. There are also accounts that are only created when you take certain actions in QuickBooks. For example, if you wanted to represent data points as both a numerical value and also a percentage. However, if your second axis is overcomplicating your Excel charts for your final deliverable, it’s good to know how to remove it with ease. The simplest form of the break-even chart, wherein total profits are plotted on the vertical axis while units sold are plotted on the horizontal axis. Additionally, if the variable cost per unit can be reduced, the P/V graph shows the additional profits that can be expected at any given sales volume.

What is a chart of accounts?

For example, if you need to create a new account for ‘PayPal Fees’, instead of creating a new line in your chart of accounts, you can create a sub-account under ‘bank fees’. Similarly, if you pay rent for a building or piece of equipment, you might set up a ‘rent expense’ account with sub-accounts for ‘building rent’ and ‘equipment rent’. Presenting your Excel graphs and charts with clear formatting is essential in making them look more professional. If you’re sharing financial charts as part of an internal report, it’s best-practice to format the charts into your company branding.

In accounting and finance, a graph is a visual representation of data that is used to illustrate relationships among financial variables. Graphs provide a clear and immediate understanding of trends, patterns, and comparisons by turning numerical data tips for holding your nonprofits first board meeting into visual images. Large and small companies use a COA to organize their finances and give interested parties, such as investors and shareholders, a clear view and understanding of their financial health. Separating expenditures, revenue, assets, and liabilities helps to achieve this and ensures that financial statements are in compliance with reporting standards.