A solid grasp on them helps in maintaining tight cost control over materials procurement. It tracks if spending goes as planned or if there are surprises needing attention. After figuring out how much material you used, it’s time to look at the prices.

- For example, if a material price variance is detected, managers should examine market conditions, supplier performance, and procurement strategies to pinpoint the cause.

- 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

- Specifically, knowing the amount and direction of the difference for each can help them take targeted measures forimprovement.

Favorable Direct Material Price Variance

The direct materials quantity variance of Blue Sky Company, as calculated above, is favorable because the actual quantity of materials used is less than the standard quantity allowed. However, a favorable direct material price variance is not always good; it should be analyzed in the context of direct material quantity variance and other relevant factors. It is quite possible that the purchasing department may purchase low quality raw material to generate a favorable direct material price variance. Such a favorable material price variance will be offset by an unfavorable direct material quantity variance due to wastage of low quality direct material. Direct material price variance is the difference between what was actually spent on the raw materials purchased during a period and the standard cost that would apply if the materials were bought at the standard rate. To calculate the variance, we multiply the actual purchase volume by the standard and actual price difference.

Diagramming direct materials variances

If actual prices for materials are lower than budgeted, the variance is favorable. That means the company spent less on materials than expected – a good thing! The result from this calculation tax form 1099 gives you the direct material price variance for your accounting records. If materials cost more than planned, your variance will be negative, showing a loss against your standard cost.

Direct Materials Quantity Variance Calculator Online

Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business owners. Keep an eye out for trends; if variances are often unfavorable, it might suggest problems with supplier pricing or purchasing practices that require attention. This clarity aids managers responsible for buying materials, like purchasing and warehouse managers, who need precise data for better sourcing decisions and negotiations with suppliers. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Meanwhile, actual cost comes from real bills and receipts showing what your company did pay.

Example of the Direct Material Price Variance

You need to know both the budgeted price and what you actually paid for each unit of material. The budgeted price is usually based on standard cost – what your company expects to pay per unit of material. Picture this—your direct materials end up costing more than expected, but you’re not sure why or by how much. That’s where understanding and computing the price variance becomes essential. However, someone other than purchasing manager could be responsible for materials price variance. For example, production is scheduled in such a way that the purchasing manager must request express delivery.

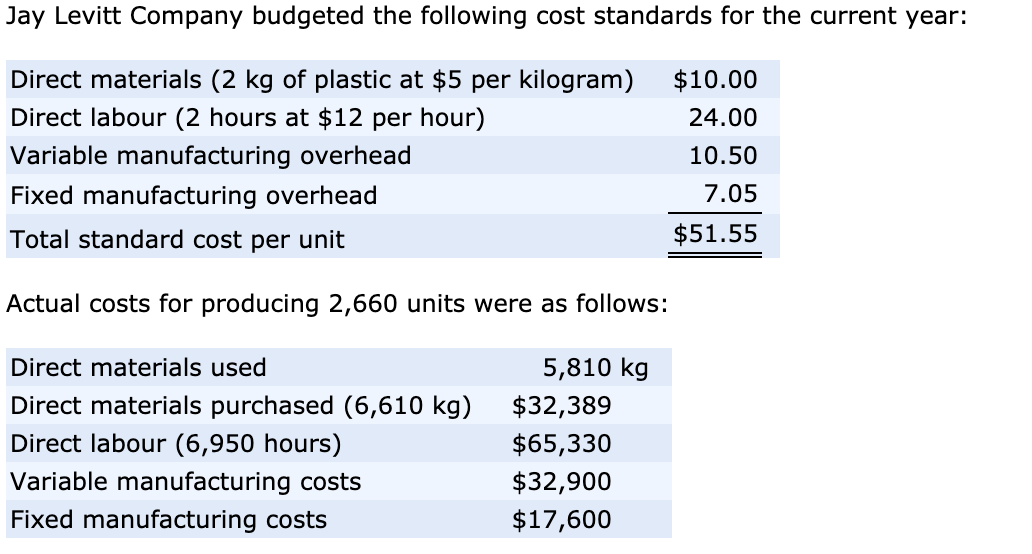

This is offset by a larger unfavorable direct materials price variance of $2,520. The net direct materials cost variance is still $1,320 (unfavorable), but this additional analysis shows how the quantity and price differences contributed to the overall variance. This variance helps businesses understand how efficiently they are managing their material costs and can highlight areas where cost control measures may be needed. The standard cost of actual quantity purchased is calculated by multiplying the standard price with the actual quantity.

This calculation helps businesses understand the efficiency of their material usage and identify areas for improvement. The direct material price variance can be meaningless or even harmful in some circumstances. For example, the purchasing manager might have engaged in heavy political maneuvering to have the standard price set unusually high, which makes it easier to generate a favorable variance by purchasing at prices below the standard.

Consequently, the variance should only be used when there is evidence of a clear price increase that management should be made aware of. Since the price paid by the company for the purchase of direct material exceeds the standard price by $120, the direct material price variance is unfavorable. Calculate the direct material price variance if the standard price and actual unit price per unit of direct material are $4.00 and $4.10 respectively; and actual units of direct material used during the period are 1,200. Another advanced technique is the application of statistical methods, such as regression analysis, to understand the relationship between different variables affecting material costs. By analyzing historical data, businesses can identify key drivers of variances and quantify their impact.

The material price variance is adverse because the actual price is higher than the standard. The material price variance in this example is favorable because the company was able to get the materials at a lower cost compared to the budget. The standard price of $100 per bag was allowed in the budget, but the purchase manager was able to source the materials from a cheaper supplier at the cost of $80 per bag. It could be because a company got a discount or faced a materials shortage.

The total price variance during January is $ 200 ($ 400 – $ 300 + $ 100), and it will impact the cost of goods sold in statement of profit and lose. We can simplify the DMPV formula by multiplying the actual purchase quantity by the price difference, as shown below. This step shows the total impact on your budget due to changes in material costs. This process helps pinpoint where costs are not aligning with your financial plans and aids in maintaining control over spending.