This can help them implement corrective actions, reduce unnecessary costs, and optimize the use of resources. For example, a manufacturing company can define and trace the costs of raw materials, labor, and overheads for each product line, and analyze the cost drivers and variances. This can help them adjust the production mix, negotiate better prices with suppliers, or improve the quality and productivity of the processes. A manufacturing company that produces multiple products with different features and specifications.

Indirect Cost Calculation Formula

It is one of the two main types of costs incurred by businesses, the other being variable costs. They are considered to be part of the cost of production, along with variable costs, and are therefore used in the calculation of total cost. From a financial reporting standpoint, defining cost objects is crucial for accurate cost allocation and financial analysis. Cost objects provide the basis for determining the cost of goods sold, inventory valuation, and cost of services rendered.

- In order to do this, we need to determine the cost centre that is related to the product.

- Businesses should regularly review their cost objects, cost drivers, and cost allocation methods, and make adjustments as needed.

- Contrastingly, common costs, also known as indirect costs or allocated costs, can’t be traced directly to a single cost object.

- It allows us to compare costs for a given product between different cost centres.

- They may assign costs to cost objects related to overhead expenses, such as rent, utilities, and insurance.

- They should also use feedback and data to evaluate the effectiveness of their cost object management and identify the areas for improvement.

Pricing & Profitability

Cost objects are any products, services, or activities that incur costs and for which managers need to measure and control costs. In this section, we will discuss some of the cost tracing techniques that can help managers allocate costs more precisely and fairly. By defining and tracing costs to cost objects, managers can monitor and compare the costs incurred for each cost object, and identify the sources of inefficiencies, waste, or overruns.

IT Managers – Who Typically Assigns Costs to Cost Objects Within an Organization?

However, now we can separate the fixed cost by different cost objects such as segment, location, and so on. In this section, we will delve into the key conclusions and takeaways regarding cost objects in the realm of cost accounting. By examining various perspectives, we can gain a comprehensive understanding of this crucial concept. Any finished goods that remain unsold are kept on a balance sheet as an asset. For that reason, a company may decide to classify certain costs as operating expenses instead of COGS. For example, a business may incur some direct labor costs even if it does not sell a single product/service.

Explanation and Examples

Human resources managers are responsible for managing the organization’s workforce. They may assign costs to cost objects related to employee compensation, benefits, and training. IT managers are responsible for overseeing the organization’s technology systems and infrastructure. They may assign costs to cost objects related to IT expenses, such as software licenses and hardware maintenance. But what exactly is a cost object, and how is it used in accounting and finance? In this blog post, we will explore the definition of cost objects, common types used in business and finance, and their role in cost accounting.

If only one window is to be installed on the building and the other is to remain in inventory, consistent application of accounting valuation must occur. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. free invoice templates Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

The manager’s wages are a direct expense of manufacturing, if we are using manufacturing as our cost object. If we are using a customer order of 1000 flyers as our cost object, then the manager’s wages are an indirect expense of that cost object. Cost objects support a company’s profitability by helping to set appropriate pricing for its products and services and maximizing the profitability in each business segment. Arguably, the most common and important cost object is a company’s output, meaning its product and service offering.

One of the most important steps in cost accounting is to define the cost objects that will be used to allocate and track costs. A cost object is anything for which a separate measurement of costs is desired, such as a product, a service, a project, a customer, or an activity. Different methods can be used to define cost objects depending on the purpose and scope of the cost analysis. In this section, we will discuss some of the common methods to define cost objects and their advantages and disadvantages. In conclusion, understanding cost objects is a crucial aspect of cost accounting and finance for any business. It allows for effective cost management and decision-making, enabling companies to accurately track expenses and allocate costs to the appropriate sources.

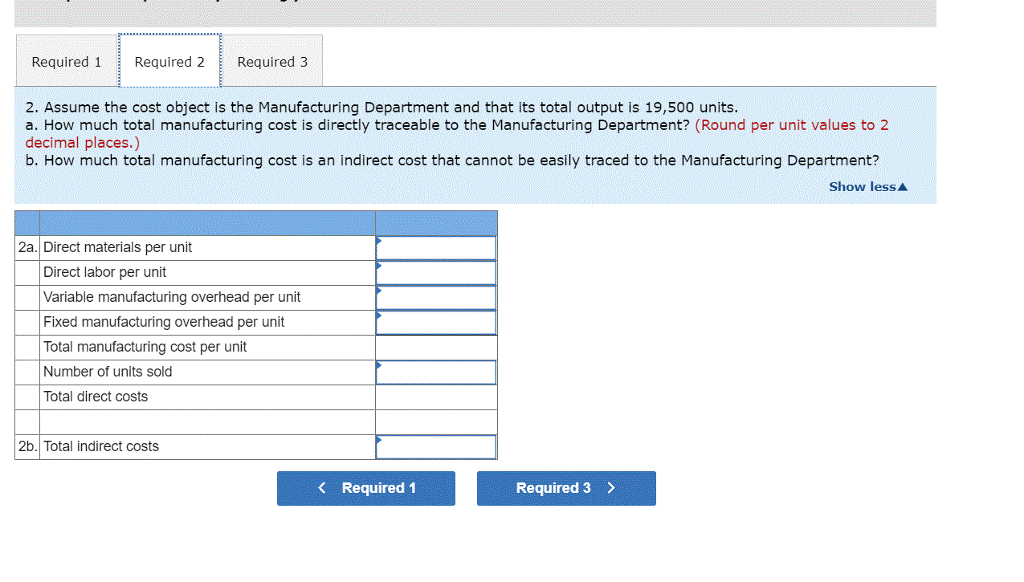

For example, a large manufacturing company may have a dedicated cost accounting team responsible for assigning costs to cost objects and analyzing the organization’s financial performance. Indirect costs (overhead costs) by nature create problems in cost determination and analysis. Direct cost related with a product can be measured with a high degree of accuracy. In the absence of appropriate direct measurement techniques, indirect costs have to be apportioned to different products. For example, suppose in a manufacturing concern there are three separate production departments and a Head Office of the company. Each of these four segments will have costs which can be directly traced to their own departments.