If you are searching getting a very rural and you can suburban lifetime – where cost of living is typically all the way down – good USDA home loan can save you cash on your own off payment and you may rate of interest.

The ability to works from another location has created another type of possibility to live everywhere you desire. As the COVID-19 restrictions are slow elevated, more a 3rd out-of staff statement continuous to the office of house aside from its place of work opening backup.

Discover a single thing – to track down an effective USDA financial, you will want to come across a qualified possessions. This is where the fresh new USDA financial map will come in.

What is actually an effective USDA Mortgage, and how Would you Apply for One?

Mortgage loans on the You.S. Institution regarding Agriculture is actually loans that will be supposed to help lowest-income family members to locate reasonable casing outside significant urban centers. These types of finance are often recommended getting borrowers which won’t if not be eligible for a vintage financial.

Exclusive advantageous asset of an effective USDA loan is the fact it does not need a downpayment – which are often the most significant monetary hindrance so you can homeownership. The fresh finance focus on for 29-season conditions from the fixed interest rates (slightly below old-fashioned loans) and can be used to get manager-occupied, single-members of the family house and condos.

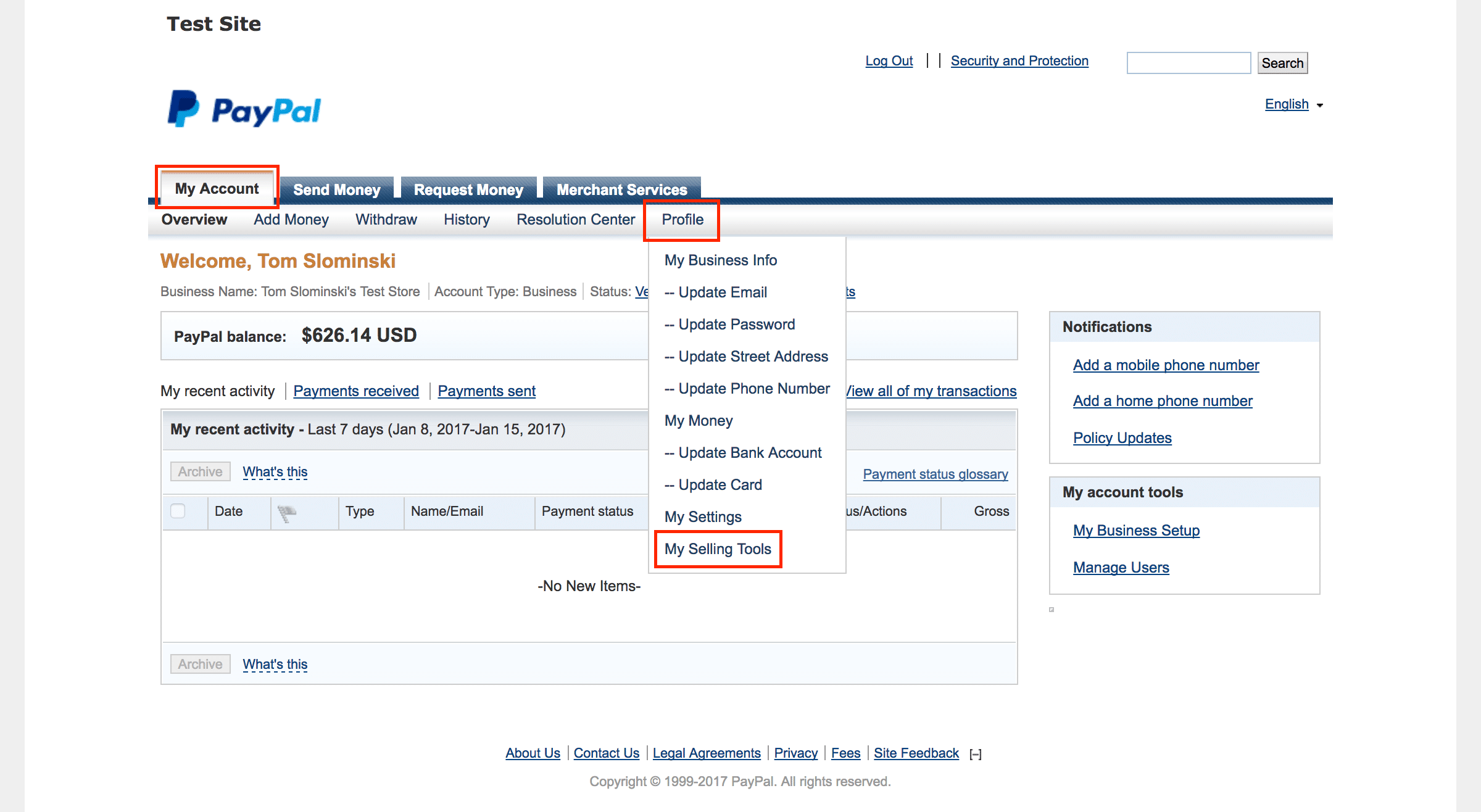

This new USDA loan application processes begins with choosing your qualification, and therefore depends on your income, credit score, or any other obligations. If you meet the requirements, you could potentially work at a good USDA-approved lending company in order to secure a home loan pre-acceptance and start in search of USDA-recognized house.

Eligibility Standards getting USDA Lenders

The fresh new regards to an effective USDA financing is great, but they’re not for everyone. To make sure you tend to be eligible for you to definitely, you will need to meet the adopting the conditions:

- Your income must be within this 115% of average domestic income limits given for the town

- You truly must be a good You.S. Resident, U.S. non-citizen federal, or licensed alien

- You’ll likely you prefer a credit rating away from 640 or more than

- Debt obligations shouldn’t meet or exceed 41% of pre-income tax money

- You need to invest in yourself undertake the dwelling since your primary quarters

- It ought to be located in this an eligible rural area

- It should be just one-relatives dwelling (which has condos, modular, and you will are created home)

- There’s no acreage maximum, nevertheless property value the latest residential property must not go beyond 31% of your own value of your house

Expert Idea

Before you get hooked on your potential domestic, take a look at USDA interactive map to find out if it’s eligible.

Just what Qualifies while the an effective Rural Area

Before you fall in love with one types of family, you’ll want to learn hence portion in the region meet the requirements towards USDA system. The USDA defines rural section relies on your location.

As a whole, these components was identified as unlock nation that’s not section of, for the people city, told you Ernesto Arzeno, a mortgage originator that have Western Bancshares.

Brand new rule of thumb is elements which have a society with smaller than simply 10,one hundred thousand, Arzeno said, whether or not you to rule is straightforward and you will timely. For some parts, according to homeownership pricing, brand new USDA allows communities doing 35,one hundred thousand, but do not greater than you to. While the designations will get transform since USDA recommendations him or her every few years.

The way you use the new USDA Financial Chart

The fresh USDA’s entertaining home loan chart ‘s the equipment one allows you will find when the a home is eligible. It works in two means: You can look actually into the target out-of a house you will be offered, and this will give you a reply from the eligibility. Or, you could browse within the chart to see which elements fundamentally are thought rural.

- https://paydayloanflorida.net/st-augustine/

- Open new USDA Home loan Map here.

Visitors with this chart isnt thus distinct from playing with Bing Charts or any other equivalent products. However, check out what you should remember while using the USDA financial chart:

Try good USDA Financial Best for you?

USDA Home loans is good path so you can homeownership, especially if you are searching to live on outside a giant town. However with one financing, you will find positives and negatives. Here’s what to consider.

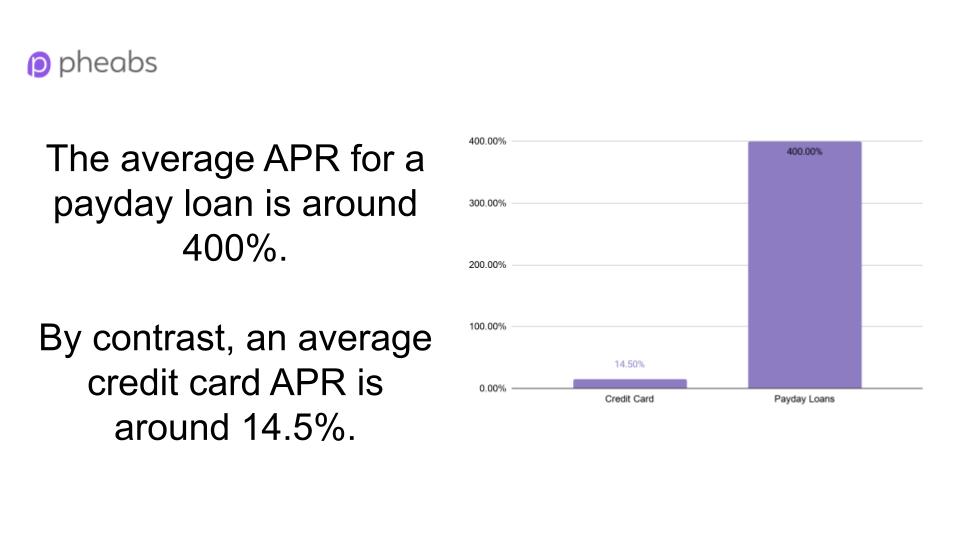

A month-to-month resource percentage (just like private mortgage insurance coverage) are placed into the loan payment. It can’t feel terminated immediately after interacting with 20% collateral.

It’s important to stress the brand new monetary downsides. Skipping a downpayment mode you’ll have a huge loan add up to shell out interest towards. Together with, a monthly financial support commission usually sign up for an entire duration of any USDA mortgage. Thereupon, make sure you thought most of the financial resource options to find hence may be the better fit for you.