What is a Break-Even Point and How to Calculate Bench Accounting

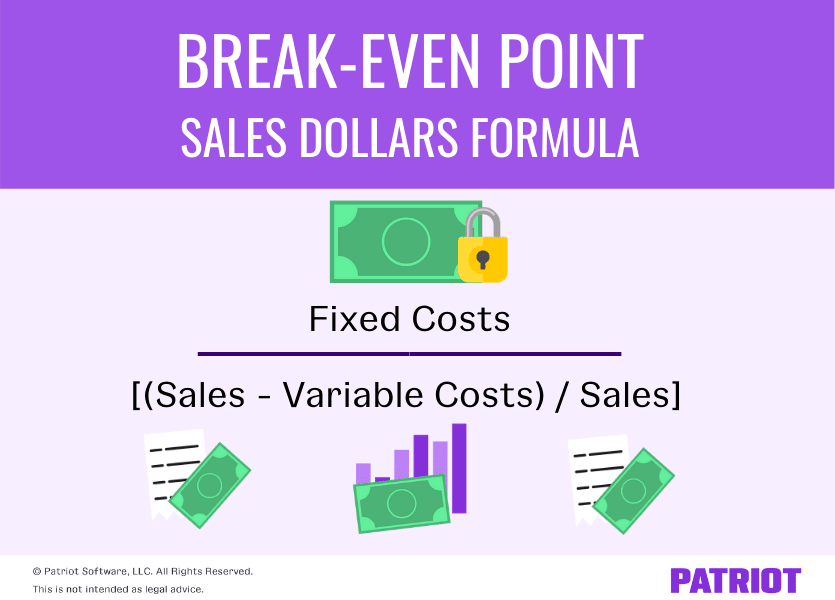

As long as total fixed and variable costs equal total revenue, the company will break even. Divide fixed costs by the revenue per unit minus the variable cost per unit. The fixed costs are those that do not change, no matter how many units are sold. Revenue is the price for which you’re selling the product minus the variable costs, like labor and materials. The break-even point formula is calculated by dividing the total fixed costs of production by the price per unit less the variable costs to produce the product. The Break Even Revenue Calculator is a vital tool for understanding how much revenue you need to generate in order to cover your operating expenses.

Using break-even analysis to determine level of production

For more cost cutting ideas, check out our guide of 25 ways to cut costs. The magic happens when our intuitive software and real, human support come together. Book a demo today to see what running your business is like with Bench. To get a better sense of what this all means, let’s take a more detailed look at the formula components. Central to the break-even analysis is the concept of the break-even point (BEP).

- Assume that an investor pays a $5 premium for an Apple stock (AAPL) call option with a $170 strike price.

- The break-even point (BEP) is the amount of product or service sales a business needs to make to begin earning more than you spend.

- A break-even analysis relies on three crucial aspects of a business operation – selling price of a unit, fixed costs and variable costs.

- It dictates everything from how to price your products to when it might be the right time to expand.

Help your small business stay profitable with better financial management

For example, you could decrease the required number of subscriptions to break even by reducing the variable costs (like using AI customer service). That’s the difference between the number of units required to meet a profit goal and the required units that must be sold to cover the expenses. In our example, Barbara had to produce and sell 2,500 units to cover the factory expenditures and had to produce 3,500 units in order to meet her profit objectives. It’s the amount of sales the company can afford to lose but still cover its expenditures.

Break-even Point Calculator

Consider the following example in which an investor pays a $10 premium for a stock call option, and the strike price is $100. The breakeven point would equal the $10 premium plus the $100 strike price, or $110. On the other hand, if this were applied to a put option, the breakeven point would be calculated as the $100 strike price minus the $10 premium paid, amounting to $90. If the price stays right at $110, they are at the BEP because they are not making or losing anything. Options can help investors who are holding a losing stock position using the option repair strategy.

Outsource fixed costs

Typically, this analysis works best for businesses that focus on a single product or service. The analysis becomes more complex and less accurate if you offer a wide range of products with different price points and variable costs. For example, If you sell both high-end electronics and low-cost accessories, a single break-even analysis won’t account for the differing profit margins. You’d need individual analyses for each product category to get a more accurate picture of your profitability. Assume a company has $1 million in fixed costs and a gross margin of 37%.

Contoh Studi Kasus BEP

Calculating the break-even point in sales dollars will tell you how much revenue you need to generate before your business breaks even. Here are four ways businesses can benefit from break-even analysis. This is a step further from the base calculations, but having done the math on BEP beforehand, you can easily move on to more complex estimates.

A breakeven point tells you what price level, yield, profit, or other metric must be achieved not to lose any money—or to make back an initial investment on a trade or project. Thus, if a project costs $1 million to garmin fenix 5 undertake, it would need to generate $1 million in net profits before it breaks even. If the stock is trading at $190 per share, the call owner buys Apple at $170 and sells the securities at the $190 market price.

Whether you're trying to promote your brand-new product, stay ahead of your competitors, or cut down on your expenses, you need to have a strategy in place. This helps you craft a more formidable strategy and reap better benefits for your company. In our example above, Maria’s break-even point tells her she needs to create eight quilts a month, right? But what if she knows she can create only six a month given her current time and resources? Well, per the equation, she might need to up her cost per unit to offset the decreased production.

If you have any other costs tied to the products you sell—like payments to a contractor to complete a job—add them to your cost of goods sold to find your total variable costs. Your fixed costs (or fixed expenses) are the expenses that don’t change with your sales volume. Some common fixed costs are your rent payments, insurance payments and money spent on equipment. These costs will stay the same regardless of whether you sell one unit or a million units. When companies calculate the BEP, they identify the amount of sales required to cover all fixed costs before profit generation can begin. The break-even point formula can determine the BEP in product units or sales dollars.

Or, if using Excel, the break-even point can be calculated using the “Goal Seek” function. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

This formula helps you determine the total revenue required to cover your operating expenses, based on your business’s gross margin. One limitation of break-even analysis is that it assumes selling prices will stay the same over time. In reality, prices often fluctuate due to market conditions, competition, or changes in demand. For example, if you run a café, you might decide to lower the price of your best-selling drink to attract more customers. While this could boost foot traffic, it also means your break-even point will change and you’ll need to sell more drinks to reach profitability. Once you’ve determined your break-even point, you’ll be able easily view how many products you need to sell and how much you’ll need to sell them for in order to be profitable.

Intuit QuickBooks Software Features

As with QuickBooks Pro, Premier will no longer be available for purchase by new users after September 30, 2024. Set up auto-pay for your team and rest easy with taxes calculated for you. Grow confidently when you’re ready with our easy-to-add solutions. Once you have a handle on the day-to-day use of QuickBooks Online, try adding a few more tips and tricks to help you get the most out of the experience. For these tasks, you can download the “QuickBooks Accounting” app from the App Store, or the “QuickBooks Online Accounting” app from the Google Play store.

What Does QuickBooks Do in Terms of Bookkeeping?

Katherine Haan is a small business owner with nearly two decades of experience helping other business owners increase their incomes. From side-hustles to complex companies, we have the tools you need to run your business. As a small business owner, it’s likely that invoicing will be the most important feature you’ll assets = liabilities + equity use in QuickBooks Online.

Bills & Expenses Tracking

- No, there’s no free version of QuickBooks for businesses, but there’s a 30-day free trial for new users.

- As with time, these billable expenses will be available to add to the customer’s next invoice.

- If you’re a freelancer, QuickBooks Solopreneur is the obvious choice.

- Payroll is an area that you don’t want to skimp on and try to do manually.

- This allocation is a requirement for calculating taxable income and is very cumbersome to do by hand.

QuickBooks Solopreneur (formerly QuickBooks Self-Employed) isn’t quite accounting software. QuickBooks Self-Employed is tax software created to help freelancers manage their finances. QBO offers up to 25 full-fledged users total and an unlimited number of time-tracking-only users. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

Track receipts and more for tax time

If you want an accounting solution with stronger features, check out our list of the top accounting software products. QuickBooks Online versions come with a free 30-day trial, so you can decide if this software is the best solution for your business. QuickBooks also regularly offers discounts on its products, such as 30% off for the first three months of use. These offers frequently change, so be sure to check its website for the latest information. To ensure you pay your employees accurately and on time, QuickBooks Payroll tracks employee time and then calculates and runs payroll automatically with the option for direct deposit. Payroll is quickbooks accountant available as standalone software or as an add-on module for other products.

It brings most of the features of https://www.bookstime.com/ the online platform, plus it enables mileage tracking and receipt capture for quick and convenient recordkeeping. QuickBooks is by far the most popular small business bookkeeping program in the US, whereas Excel is a spreadsheet program that advanced users may use to create their own custom bookkeeping program. While we don’t recommend using Excel as your base bookkeeping program, we do have a guide on how to use Excel for accounting. Our comparison of QuickBooks Online vs Excel will help you better understand the differences between the two programs.

- However, QuickBooks Online will suffice for most small businesses.

- QuickBooks Online is available both as a desktop application and an online SaaS (software as a service) model.

- All these apps integrate seamlessly with each other and QuickBooks accounting software, thus building a well-rounded accounting and payments ecosystem for your small and mid-sized business.

- Specific modules with additional functionality can be added and removed as your company grows and changes.

- Here are our recommended product combinations within the QuickBooks ecosystem, categorized by your business size.

Once you’ve finished reading this guide, you’ll know how to find the core QuickBooks tools you need quickly and efficiently. The two versions are independent of each other, which means the data you enter on Desktop doesn’t sync to the Online version and vice-versa. In addition to the desktop solutions for Windows, QuickBooks offers a solution for Mac users similar to QuickBooks Desktop Pro. This software works best for non-manufacturing small businesses.

- While the Desktop version has app integrations, it doesn’t have near as many as the Online version.

- For Xero’s Early plan ($13), the number of invoices that users can send each month is capped at 20, but for all other Xero plans, users can send unlimited invoices.

- QuickBooks Desktop is a good choice if you need specialized features such as inventory tracking or forecasting, and you don’t mind paying more for them.

- QuickBooks is a widely used accounting software that helps businesses manage their income, payroll, and inventory more effectively.

- QuickBooks is one of the most popular accounting software for small businesses in 2024.

- Two additional pages in the dashboard provide more cash flow details and a big chart that toggles between a customizable view of your cash balance and money flow.

Today’s leading accounting platforms offer standard security features such as data encryption, secure credential tokenization and more. Intuit reports that 94% of accounting professionals feel QuickBooks Online saves them time and thus saves their clients’ money. While QuickBooks Online is very popular among business owners, some have problems with the system. Problems stem from the complexity of making simple fixes, such as miscategorizations or duplicate entries. Support is limited, so users are left reading help articles rather than getting a live person to help. QuickBooks desktop also supports a migration feature where customers can migrate their desktop data from a pro or prem SKU's to Quickbooks Online.

The initial release of QuickBooks was the DOS version that was based on the Quicken codebase. The Windows and Mac versions shared a different codebase that was based on In-House Accountant, which Intuit had acquired. The software was popular among small business owners who had no formal accounting training. As such, the software soon claimed up to 85 percent of the US small business accounting software market.

What is a Sales Invoice? Comprehensive Guide & Free Templates

As a receivable transaction, the sales invoice prompts the customer for payment. However, sales invoice is a term for a specific type of invoice, but it’s often confused with other types of invoices. Understanding this distinction can help ensure your payments are handled smoothly.

- So, always contemplate what’s possible and cost-effective for your small business.

- A credit invoice is issued when a business needs to provide a customer with a refund or discount and will include a negative amount to cover the cost of the amount returned to the customer.

- You can use the tax invoice templates that come in-built with QuickBooks to create and send online invoices to your customers.

- This could cover return policies, warranties, or any other relevant information.

Essential Soft Skills for a Successful Career in Finance or Accounting

“Invoice” should be splashed large and bold across the top to prevent confusion with other similar-looking documents. If you’re working on several invoices, feel free to add a date or specific deal name for more specificity. Let’s dive a little deeper into the most important pieces of information to include in a sales invoice. The best way to get your customers to pay faster is to offer different payment methods.

Send Recurring Invoices

Cellular, software, and Internet providers, for example, generally use a recurring invoice system to bill their customers. Long-term customers can also use invoice software to automate consistent payments. A pro-forma invoice is sent to the customer before goods or services are rendered. Rather than a typical sales invoice requesting payment right away, the pro-forma invoice informs the customer what they can expect to pay once the items or services are provided. Invoicing https://www.bookstime.com/articles/debt-ratio can be a somewhat time-consuming process if done manually, but automation is fairly simple.

- “Standard invoice terms” refer to the guidelines defining when and how payments will be made.

- For example, if a customer signed up late in the month, the bill may only be for 15 days of that first month.

- They help businesses meet government regulations, assist in audits, and prevent disputes through clearly defined payment terms, tax information, and legally binding elements.

- As a small business owner, you might be sending multiple invoices each month to customers.

Sales Invoices vs. Purchase Orders

A key way streamline your invoicing efforts, is to make the payment process easy. Providing customers what is sales invoice with an easy way to pay your invoice will encourage on-time payments and improve their experience with your company. Past due invoices can impact your cash flow, and collecting overdue invoices can cost business owners time and energy. Writing clear, easy to understand invoices and offering a variety of payment options can help to reduce the risk of an invoice being past due.

- Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries.

- Even small mistakes can have significant consequences, from delayed payments to legal disputes.

- If you’re using a template, make sure the template includes all the fields you need.

- The document includes the exact date it was created, so the buyer has to follow the deadline.

- When your customer’s journey ends, make sure you’re ready to provide them with everything they need to pay you.

- While this is relatively straightforward with physical products, it gets a bit more complex with consumption and subscription models.

Supports effective inventory management

Add a personal touch by sending an accompanying message when issuing the invoice, either by email or in your accounting software’s interface. The piece of paper you get when buying something from a shop is a simple example of a sales receipt – it acts as a record of payment for the purchase. The buyer and seller should keep copies of the receipt for bookkeeping and budgeting purposes. The three most common sales documents https://x.com/BooksTimeInc aside from invoices are purchase orders, sales orders and sales receipts.

Find the best invoicing software

While many businesses list phrases or periods (such as “due in 30 days” or “due upon receipt”), it’s best to list an exact due date to avoid confusion and ensure timely payment. Learn all about sales invoices, including how they work, key elements, and steps to creating your own sales invoice. Every invoice contains key elements that must be included to accurately record the details of the sale, eliminate confusion, and receive timely payment.

Make it clear that you (or someone on your accounting team) are on hand to answer questions, too. If a buyer has concerns and doesn’t know how to raise them, they might turn their attention to another task and cause a delay. Address your recipient by name and use the same tone as you would in any other correspondence with that customer.

Sales invoice vs. service invoice

If so, check out our article on How to Pay an Invoice, where we have explained the process in detail, along with tips that will help you pay your invoices on time. As long as you’ve met the requirements of a legal invoice, it’s largely up to you what else you include. However, you should never include unclear product/service descriptions, spelling or math mistakes, or incorrect contact information for either you or the other party. Looking for an example of a professional invoice for use in your business?

- Customers want to see and understand the breakdown of what they owe and so does your accounting department.

- This step is essential for ensuring the accuracy of financial records and for identifying any unpaid invoices that may need further follow-up.

- Ensure your invoice includes all the details your clients will need to pay you, including your business name, the invoice due date, and the total amount due.

- Invoices aren’t necessarily due immediately when customers receive them.

- Implementing an invoicing workflow is a no-brainer and thanks to technology, it doesn’t need to be a complicated process.

- You may also choose to collect half of the payment upfront, collect partial payments over time, or require immediate payment upon completion.

You’ll inevitably have to chase payment from a customer at one point or another. This is never ideal but there are ways to minimize disruption and maintain good relations. There is no need for you to manually calculate the amount of tax, discounts, and shipping costs, as QuickBooks does it for you.

Accounting Software for Small Businesses

Finally, comparing QuickBooks Online vs. Xero, Xero stands out with their customer service. Plus, Xero doesn’t outsource their customer service—all representatives are Xero employees. Moreover, if you want to add payroll capabilities to your Xero plan, you can take advantage of Xero’s partnership with Gusto payroll for direct, full-service payroll integration. Plus, Gusto offers two months of their services free for Xero customers. With the Xero Expenses feature set, you can track, assign, and manage your business’s expense claims.

Feature set includes an excellent mobile app and suite of reports, capable invoicing features, plus automated bill and receipt capture through Hubdoc. After a 30-day trial period, Xero will bill a monthly charge of $13 per month for the Early plan, $37 per month for the Growing plan and $70 per month for the Established plan. For free invoicing platforms, consider Zoho Invoice, Square Invoices or PayPal Invoicing, although these platforms provide fewer capabilities. Keep in mind that the ability to use multiple currencies in the software and invoice is limited to the company’s highest tier, at $70 per month. If using multiple currencies is a priority to you, consider other platforms that offer this capability at a lower cost.

Automated features to save you time

Although Xero offers three different plans, the first plan extremely limits the number of invoices, bills, and quotes you can utilize. Plus, if your business needs functionality beyond these limitations, you have to opt for the Growing plan, which is more than 3x as expensive as the Early plan. On the other hand, finding the value of old books Xero may be the better choice for your business. Xero is strong accounting software that has everything you need to track the financials of your business. Some of its features really stand out, such as its customer management system.

Why You Can Trust Fit Small Business

It’s also a good fit if you want to integrate Gusto Payroll to your accounting platform. Xero’s invoicing capabilities allow you to create and customize an invoice for clients and then accept credit card, debit card or bank transfer payments within the invoice itself. Account holders are able to customize online invoices to add a logo, accept payments instantly through the invoice, set automatic reminders for clients to pay and invoice directly from the Xero app.

Bank reconciliation

- Zoho, for example, is accounting software with a free invoice platform that allows you to bill in multiple currencies.

- Additionally, when it comes to customizing reports, QuickBooks Online has more to offer versus Xero.

- Plus, when you factor in the accounting tools and general features involved with each individual plan, it’s easy to argue that both Xero and QuickBooks Online are appropriately priced for their services.

- It also has mobile apps that, according to users, outperform other popular accounting software apps.

Xero utilizes an App Marketplace with over 1,000 apps to extend its core functionality. Create professional custom invoices with your logo that you can send from any device. Get the most out of Xero with access to our team of onboarding specialists during your first 90 days.

The A/P section focuses on vendor management, bill management, bill payments, and other payable-related transactions. A/P features include creating vendors and bills, recording purchase orders and converting them to bills, creating service items, and recording full or partial bill payments. QuickBooks Online takes the lead because it’s generally easier to use than Xero.

One upside that Xero offers when you’re corporate title entering transactions is that if the transaction involves a product or service that you offer, you can transfer it to any account while you’re in the transaction. When you link up your Xero account to download transactions from your bank, you have to set up the right starting balance per the bank. From that point, your balance per bank is a calculated balance—this calculated balance can be manipulated, meaning it can be incorrect.

Xero supports unlimited users with all its subscription plans, while QuickBooks allows only up to 40 users with its highest-tiered plan. While Xero and QuickBooks Online have a lot in common (i.e., advanced features and numerous integrations), there are a few features that separate gap 200 090 plant and equipment depreciation the two. Xero comes out on top for its support of unlimited users at no additional cost — something that is pretty much unheard of in the accounting software world.

The Ultimate Guide to Cost Object in Cost Accounting Systems

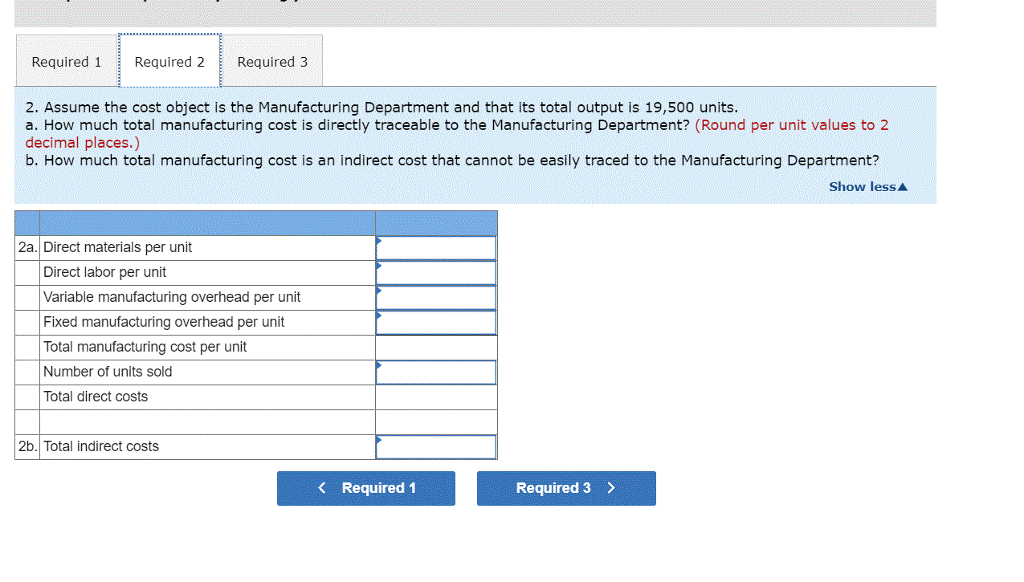

This can help them implement corrective actions, reduce unnecessary costs, and optimize the use of resources. For example, a manufacturing company can define and trace the costs of raw materials, labor, and overheads for each product line, and analyze the cost drivers and variances. This can help them adjust the production mix, negotiate better prices with suppliers, or improve the quality and productivity of the processes. A manufacturing company that produces multiple products with different features and specifications.

Indirect Cost Calculation Formula

It is one of the two main types of costs incurred by businesses, the other being variable costs. They are considered to be part of the cost of production, along with variable costs, and are therefore used in the calculation of total cost. From a financial reporting standpoint, defining cost objects is crucial for accurate cost allocation and financial analysis. Cost objects provide the basis for determining the cost of goods sold, inventory valuation, and cost of services rendered.

- In order to do this, we need to determine the cost centre that is related to the product.

- Businesses should regularly review their cost objects, cost drivers, and cost allocation methods, and make adjustments as needed.

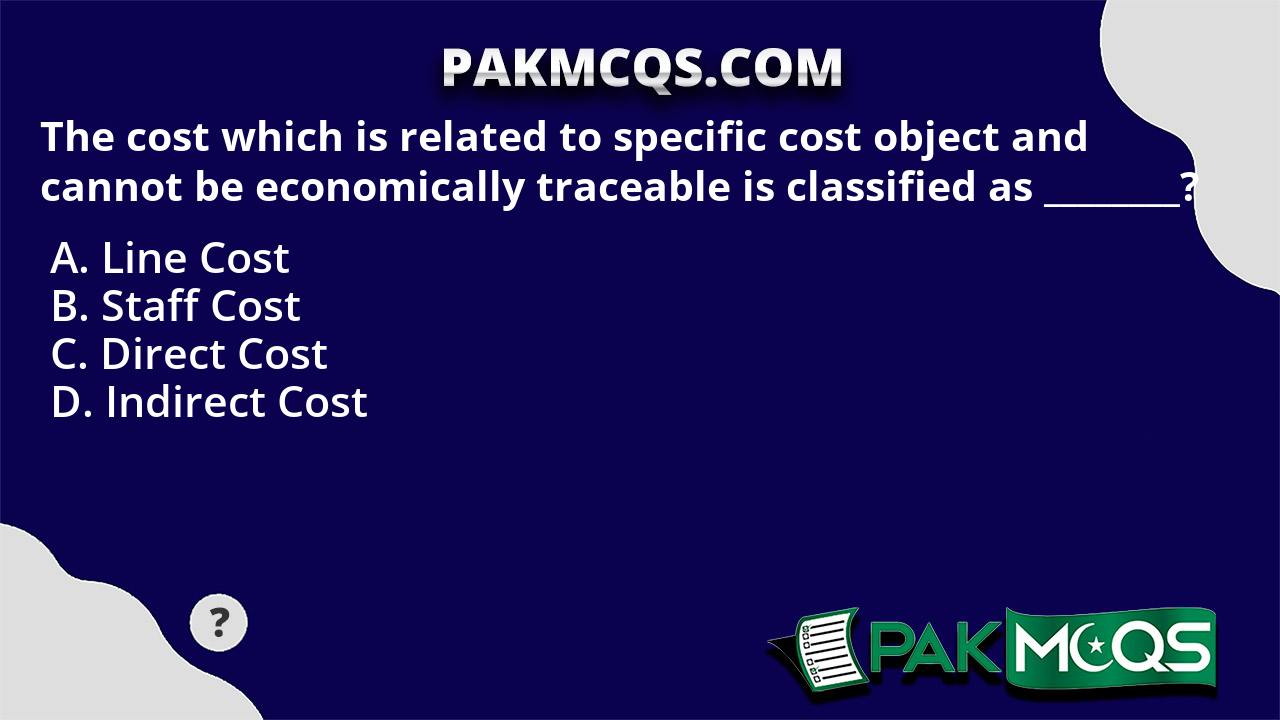

- Contrastingly, common costs, also known as indirect costs or allocated costs, can’t be traced directly to a single cost object.

- It allows us to compare costs for a given product between different cost centres.

- They may assign costs to cost objects related to overhead expenses, such as rent, utilities, and insurance.

- They should also use feedback and data to evaluate the effectiveness of their cost object management and identify the areas for improvement.

Pricing & Profitability

Cost objects are any products, services, or activities that incur costs and for which managers need to measure and control costs. In this section, we will discuss some of the cost tracing techniques that can help managers allocate costs more precisely and fairly. By defining and tracing costs to cost objects, managers can monitor and compare the costs incurred for each cost object, and identify the sources of inefficiencies, waste, or overruns.

IT Managers – Who Typically Assigns Costs to Cost Objects Within an Organization?

However, now we can separate the fixed cost by different cost objects such as segment, location, and so on. In this section, we will delve into the key conclusions and takeaways regarding cost objects in the realm of cost accounting. By examining various perspectives, we can gain a comprehensive understanding of this crucial concept. Any finished goods that remain unsold are kept on a balance sheet as an asset. For that reason, a company may decide to classify certain costs as operating expenses instead of COGS. For example, a business may incur some direct labor costs even if it does not sell a single product/service.

Explanation and Examples

Human resources managers are responsible for managing the organization’s workforce. They may assign costs to cost objects related to employee compensation, benefits, and training. IT managers are responsible for overseeing the organization’s technology systems and infrastructure. They may assign costs to cost objects related to IT expenses, such as software licenses and hardware maintenance. But what exactly is a cost object, and how is it used in accounting and finance? In this blog post, we will explore the definition of cost objects, common types used in business and finance, and their role in cost accounting.

If only one window is to be installed on the building and the other is to remain in inventory, consistent application of accounting valuation must occur. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. free invoice templates Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

The manager’s wages are a direct expense of manufacturing, if we are using manufacturing as our cost object. If we are using a customer order of 1000 flyers as our cost object, then the manager’s wages are an indirect expense of that cost object. Cost objects support a company’s profitability by helping to set appropriate pricing for its products and services and maximizing the profitability in each business segment. Arguably, the most common and important cost object is a company’s output, meaning its product and service offering.

One of the most important steps in cost accounting is to define the cost objects that will be used to allocate and track costs. A cost object is anything for which a separate measurement of costs is desired, such as a product, a service, a project, a customer, or an activity. Different methods can be used to define cost objects depending on the purpose and scope of the cost analysis. In this section, we will discuss some of the common methods to define cost objects and their advantages and disadvantages. In conclusion, understanding cost objects is a crucial aspect of cost accounting and finance for any business. It allows for effective cost management and decision-making, enabling companies to accurately track expenses and allocate costs to the appropriate sources.

For example, a large manufacturing company may have a dedicated cost accounting team responsible for assigning costs to cost objects and analyzing the organization’s financial performance. Indirect costs (overhead costs) by nature create problems in cost determination and analysis. Direct cost related with a product can be measured with a high degree of accuracy. In the absence of appropriate direct measurement techniques, indirect costs have to be apportioned to different products. For example, suppose in a manufacturing concern there are three separate production departments and a Head Office of the company. Each of these four segments will have costs which can be directly traced to their own departments.

Vertical Analysis Financial Edge

Businesses that experience seasonal fluctuations in their revenue and expenses may find that vertical analysis provides an incomplete picture. For instance, a retail company might see a spike in revenue during the holiday season, which could skew the percentage calculations and lead to misleading conclusions if not taken into account. For example, many businesses use vertical analysis to compare their financial results to those of other businesses in their industry. When using horizontal analysis, balance sheet totals for two periods are required. When compared to one another, the balance sheets of companies with values of one billion and half a million dollars might be difficult to interpret.

Integrating vertical analysis into financial reporting and communication

When comparing different financial accounts, vertical analysis is a useful tool and a well-known strategy to use. In addition to the financial success of businesses, when combined with horizontal analysis, vertical analysis allows for the generation of a comprehensive picture of the financial status of an organization. You can compare companies in the same industry by standard comparisons of key line items. By comparing other companies’ percentages against your own, you can understand the strengths, weaknesses, and changes you will need to make. With Acterys, FP&A professionals can conduct thorough vertical analysis and make well-informed decisions thanks to its scenario planning and collaboration features. This empowers organizations to drive business growth by unlocking the true potential of their financial data and harnessing the advantages of vertical analysis for strategic decision-making.

The Future of FP&A: How The Role Is Evolving With The Use Of Real-Time Data

Vertical analysis of financial statements is where each line item on your company’s financial statement is listed as a percentage of the base figure on the statement. Vertical analysis can be used with both income statements and balance sheets, with every line item on the financial statement entered as a corresponding percentage of the base item. Also known as common-size analysis, vertical analysis can help analyze company performance, but it is also a useful tool for comparing the financial statements of two companies.

Vertical Analysis using Balance Sheet

A research conducted by the Indian Institute of Management (IIM) found that Indian companies using vertical analysis were better able to manage their operational costs. Cash in the current year is $110,000 and total assets equal $250,000, giving a common-size percentage of 44%. If the company had an expected cash balance of 40% of total assets, they would be exceeding expectations. The figure below shows the common-size calculations on the comparative income statements and comparative balance sheets for Mistborn Trading. The highlighted part of the figure shows the number used as the base to create the common-sizing.

Percentage Calculation

Financial statement items are reported as percentages of one another to facilitate vertical analysis. This step is taken in order to ensure that the analysis is carried out in the most thorough manner possible. This article defines vertical analysis, describes its process, and provides many trend assessments of current vertical analysis applications. Before http://www.snezhny.com/profile.php?id=755 conducting vertical analysis, having all the data needed for the calculation is critical. The following example shows ABC Company's income statement over a three-year period. Here, analysts and FP&A teams can get a clear view of the company asset allocation, look at how liabilities compare to company assets, and review the equity structure of the business.

Startup Financial Model Template

Horizontal analysis studies changes to variables over time, using historical data to predict future trends. Vertical analysis, however, studies the proportions of the total amount represented by the different variables during a single period. One of the pros of vertical analysis is that it allows for the comparison of financial statements from one accounting period to the next as well as for comparisons among different companies.

Steps to prepare vertical analysis with your balance sheet

Vertical analysis provides insights into the composition of your financial statements and their relationship with the base amount. Also known as the vertical percentage analysis, you can then use this to http://www.yurclub.ru/docs/corporate/article60.html evaluate company performance and compare it with previous results to understand the direction of your company. In order to use the vertical analysis equation, you need to figure out your base figure.

Vertical analysis vs horizontal analysis

- Salaries and marketing expenses have risen, which is logical, given the increased sales.

- If they were only expecting a 20% increase, they may need to explore this line item further to determine what caused this difference and how to correct it going forward.

- Financial statements that include vertical analysis clearly show line item percentages in a separate column.

- The assets section is informative with regard to understanding which assets belonging to the company constitute the greatest percentage.

Vertical analysis is a method of financial statement analysis in which each line item is shown as a percentage of the base figure. It is most commonly used within a financial statement for a single reporting period. For example, by showing the various expense line items in the income https://www.ezocat.ru/index.php/mir-krisis-ks/6185-korpo-upravlen-1 statement as a percentage of sales, one can see how these are contributing to profit margins and whether profitability is improving over time. The above vertical analysis example shows the company's net profit where we can see the net profit in both amount and percentage.

- Both assets and liabilities/equity have a base number assigned, which is always 100%.

- These examples demonstrate how vertical analysis allows for meaningful comparisons, identification of trends, and assessment of the relative proportions and relationships within financial statements.

- We saved more than $1 million on our spend in the first year and just recently identified an opportunity to save about $10,000 every month on recurring expenses with Planergy.

- The common-sized accounts of vertical analysis make it possible to compare and contrast numbers of far different magnitudes in a meaningful way.

- The first step of vertical analysis is to make a new income statement, such as the common size income statement stated below.

It offers a better way to perform flux and budget variance analysis by automating the data collection process and integrating with your ERP. For each line item on the balance sheet, divide it by the Total Assets and multiply the result by 100. Let’s look at an example to see how applying the vertical analysis formula might work in the real world. The dollar change is found by taking the dollar amount in the base year and subtracting that from the year of analysis.

Accounting Software for Small Businesses

All firms listed in the directory have staff members trained in Xero and eight or more clients on Xero. We also have online articles, videos and training available. Get to know your finances with accurate, daily figures when you’re accounting online with Xero. An accountant or bookkeeper can be useful set of hands to help with the accounting heavy lifting. Use simpler versions of Xero for small businesses and clients whose needs are more limited.

Accounting software for your US small business

Xero partners have what is a customer deposit access to a wealth of business and accounting tools to support their clients, market their accounting practice, and grow their business. As you move from new partner to bronze, silver, gold and platinum status levels, you’ll unlock more and more benefits. You can import data from another accounting system in bulk via CSV files once you’ve done the initial set up in Xero. That includes the chart of accounts, invoices, bills, contacts and fixed assets.

With shared access to Xero for invited users, you can collaborate within your team, with your clients, as well as with the experts at Xero. Xero’s online accounting software and pricing plans are designed for small businesses, plus it’s free for you to use to run your own practice. With your accounting software and data stored in the cloud, you can access your up-to-date accounts anywhere there’s an internet connection.

Xero for large accounting firms

This includes the ability fob shipping point to sort, filter, group, and customise the data you want to see. You’ll also have the ability to export your client list to Excel. New details will include trading name/legal name, Xero organisation name, business number and financial year-end date. Shortly after the rollout, we’ll also add connected banks and unreconciled bank items, and UK Partners will be able to access bank feed expiry dates.

Free accounting software, training and support

Get the most out of Xero with access to our team of onboarding specialists during your first 90 days. Working more effectively allows you to lower prices and attract new clients – or to claim back some hours in your day. Become eligible for discounts on client subscriptions, and choose whether to pass them on.

- Organising client documents, sending them out to be signed, and getting them back correctly can take time.

- We also have online articles, videos and training available.

- You can even reconcile bank accounts and convert quotes to invoices.

- Working more effectively allows you to lower prices and attract new clients – or to claim back some hours in your day.

- Work faster using Xero HQ in your bookkeeping or accounting practice.

Run your business from anywhere with Xero’s easy accounting app. Keep track of your unpaid and overdue invoices, bank account balances, profit and loss, cash flow and bills to pay. You can even reconcile bank accounts and convert quotes expenditure definition to invoices. It’s free with every subscription and compatible with iOS and Android. We’re piloting a new feature that will connect small businesses without an advisor to practice staff with relevant expertise.

Collaborate with your peers, support your clients and boost your practice. Xero partners with you on your journey, helping you achieve your vision of a collaborative, future-focused firm using cloud accounting software. Xero provides multiple layers of protection for the personal and financial information you entrust to Xero accounting software. Security is a priority for Xero, as we know it is for you, so it’s also important you also take steps to safeguard your data.

Xero accounting and bookkeeping partners can also offer basic plans to clients who just need the essentials. We’re upfront about pricing, and provide full details of our pricing plans and optional extras. Xero is powerful online accounting software for US small businesses. Manage your cash flow, track expenses, accept payments online, and much more – all without leaving Xero. Access client and practice management software that will transform the way you work.

Take and process payments in QuickBooks Online with QuickBooks Payments

In this article, we will guide you through the process of setting up QuickBooks Payments. Whether you’re using QuickBooks Desktop or QuickBooks Online, we’ve got you covered. We’ll also provide information on how to initiate the setup process from a web browser. Additionally, we’ll touch upon some common issues that you may encounter during the setup and offer troubleshooting tips to resolve them. Set up QuickBooks Online to receive and process payments online, in-person, or over the phone with QuickBooks Payments.

How To Record Deposits In Quickbooks Online

The ability to send an invoice from QuickBooks Online via text message isn't available. We don't have a specific time frame as to when this feature is going to be available. Please note, QuickBooks customers must apply for QuickBooks Payments and be approved before they can begin to use the service.

How to Create Videos From Text Advanced Software and Online Tool

- There's a 2.4% fee for swiped credit cards, a 2.9% fee for invoiced and 3.4% for keyed plus .25 per transaction.

- You can also print a copy of the receipt through QuickBooks Online Payments.

- Begin by selecting the (+) plus sign from the top menu, then select Invoice.

- The option to add a notification abut the processing fee isn't available.

For more information, review the Intuit Merchant Agreement, privacy policy, and pricing documents here. Know that our developers are always finding considering new functionalities to be added to cope with your business needs. That said, I'd encourage you to visit our QuickBooks Online Blog site regularly to be updated with our latest news and product road-maps. If the same thing happens, it would be best to contact our Merchant Service Team. They have additional tools to pull up your account in a secure environment and investigate this further.

Sign In

You can check this article for the detailed steps on how to record Bank Deposits in QuickBooks Online.

If you’re a business owner or an accountant, you know how important it is to have a seamless and efficient payment processing system. QuickBooks Payments is a feature-rich solution that allows you to accept credit card payments, manage invoices, and handle all your financial transactions right within the QuickBooks ecosystem. I'd like to know why you don't let people know they will be charge astronomical fees for using credit card payments. I let a client pay with credit card for the last 6 months and only after digging through my bank account realized I was being charged. You should let your clients know they are being charged a fee at the time of the transaction.

Receive and process payments in QuickBooks Online with QuickBooks Payments

I figured that as a business owner, since this is not an uncommon practice for businesses to pass that fee along to the clients, it would not be unheard of to do the same if I so decided. I understand that some of your customers don't want to open their invoices for some reason. With this, you may have to add the credit card details to their profiles understanding current assets on the balance sheet at once, then enable the autopay feature so they don't need to click on the invoice or key in the account number each time.

If your customer agrees that they will be the one to handle the processing fee, you can add the fee as a second line item on the invoice. You have just sent your first trackable invoice with a Pay now button so your customers can pay you securely online through card or bank transfer. You’ll be able to see when your invoice is sent, viewed, and paid through QuickBooks Payments. Once Payments is set up and your account is approved, you will be ready to process and send your first invoice. Begin by selecting the (+) plus sign from the top menu, then select Invoice. Thanks for choosing QuickBooks Payments to manage your business!

Financial Ratio Analysis Calculator

A free best practices guide for essential ratios in comprehensive financial analysis and business decision-making. When performing ratio analysis over time, be mindful of seasonality and how temporary fluctuations may impact month-over-month ratio calculations. Times Interest Earned is used to measure a company's ability to meet its debt obligations. Days Receivables indicates the average number of days that receivables what is the difference between revenues and earnings are outstanding. High numbers indicate long collection periods, low numbers indicate efficient collection of receivables.

- Use the Days Receivables Calculator to calculate the days receivables from your financial statements.

- A ratio is the relation between two amounts showing the number of times one value contains or is contained within the other.

- Earnings not paid to shareholders are expected to be retained by the company and invested in further operations.

- Use the Du Pont Analysis Calculator above to calculate the Du Pont Ratios from your financial statements.

It is possible to analyze the efficiency with which a company’s assets generate pretax income, and allocate this income in proportion to the capital structure. We can then determine the amount that each set of assets contributes to net income. We would expect that management would be able to use assets financed by debt to generate enough net income to pay the borrowing costs, and hopefully produce additional income for the shareholders. Comparing financial ratios with that of major competitors is done to identify whether a company is performing better or worse than the industry average.

Cash Flow

However, if the majority of competitors achieve gross profit margins of 25%, that's a sign that the original company may be in financial trouble. Investors and analysts use ratio analysis to evaluate the financial health of companies by scrutinizing past and current financial statements. For example, comparing the price per share to earnings per share allows investors to find the price-to-earnings (P/E) ratio, a key metric for determining the value of a company's stock. A company’s assets can be divided into assets funded by equity, and assets funded by debt.

Paycheck & Benefits

The balance sheet shows the value of a company's accounts at a given point in time. The income statement shows the financial effects of activities over a given period of time. This can be combined with additional ratios to learn more about the companies in question. If ABC has a P/E ratio of 100 and DEF has a P/E ratio of 10, that means investors are willing to pay $100 per $1 of earnings ABC generates and only $10 per $1 of earnings DEF generates.

Efficiency Ratios

Ratio analysis can help investors understand a company's current performance and likely future growth. However, companies can make small changes that make their stock and company ratios more attractive without changing any underlying financial fundamentals. To counter this limitation, investors also need to understand the variables behind ratios, what information they do and do not communicate, and how they are susceptible to manipulation. Ratio analysis is a method of examining a company's balance sheet and income statement to learn about its liquidity, operational efficiency, and profitability.

For example, comparing the return on assets between companies helps an analyst or investor to determine which company is making the most efficient use of its assets. Du Pont Analysis is used to identify the components of business operations that lead to shareholders return. Total return on equity is the profitability, multiplied by the rate of asset turnover, multiplied by the ratio of assets to equity (leverage). By identifying each component and evaluating, strength and weakness can be evaluated, as well as insight into competitive advantage. Understanding how each element leads to return on equity will help a researcher investigate further into the operations of a company.

Hypothetical illustrations may provide historical or current performance information. Use the Dividend Payout Ratio Calculator above to calculate the dividend payout ratio from your financial statements. Inventory what is the death spiral Turnover Period in Days measures how many days it takes for a company to turnover its entire inventory. Use the Operating Margin Calculator to calculate the operating margin from your financial statements. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Use the Inventory Turnover Period in Days Calculator to calculate the inventory turnover period in days from your financial statements. There is often an overwhelming amount of data and information useful for a company to make decisions. To make better use of their information, a company may compare several numbers together. This process called ratio analysis allows a company to gain better insights to how it is performing over time, against competition, and against internal goals. Ratio analysis is usually rooted heavily with financial metrics, though ratio analysis can be performed with non-financial data. To perform ratio private accounting vs public accounting analysis over time, select a single financial ratio, then calculate that ratio at set intervals (for example, at the beginning of every quarter).

Accounting Equation Overview, Formula, and Examples

These are some simple examples, but even the most complicated transactions can be recorded in a similar way. During the month of February, Metro Corporation earned a total of $50,000 in revenue from clients who paid cash. Regardless of how the accounting equation is represented, it is important to remember that the equation must always balance. So, let’s take a look at every element of the accounting equation.

The relationship between the accounting equation and your balance sheet

Just like the accounting equation, it shows us that total assets equal total liabilities and owner’s equity. It is sometimes called net assets, because it is equivalent to assets minus liabilities for a particular business. ” The answer to this question depends on the legal form of the entity; examples of entity types include sole proprietorships, partnerships, and corporations. A sole proprietorship is a business owned by one person, and its equity would typically consist of a single owner’s capital account.

- Liabilities are what it owes, and equity is the amount of the company that belongs to the business owner.

- This includes expense reports, cash flow and salary and company investments.

- Corporate shares are easily transferable, with the current holder(s) of the stock being the owners.

- This number is the sum of total earnings that were not paid to shareholders as dividends.

Example: How to Calculate the Accounting Equation from Transactions

To learn more about the income statement, see Income Statement Outline. To learn more about the balance sheet, see our Balance Sheet Outline. Parts 2 – 6 illustrate transactions involving a sole proprietorship.Parts 7 – 10 illustrate almost identical transactions as they would take place in a corporation.Click here to skip to Part https://www.bookstime.com/ 7. Liabilities are what it owes, and equity is the amount of the company that belongs to the business owner.

Financial statements

- Parts 2 – 6 illustrate transactions involving a sole proprietorship.Parts 7 – 10 illustrate almost identical transactions as they would take place in a corporation.Click here to skip to Part 7.

- The accounting equation works on the double-entry bookkeeping principle, where every transaction affects at least two accounts in the books to maintain balance.

- Unearned revenue from the money you have yet to receive for services or products that you have not yet delivered is considered a liability.

- This observation tells us that accounting statements are important in investment and credit decisions, but they are not the sole source of information for making investment and credit decisions.

- Their share repurchases impact both the capital and retained earnings balances.

If a business buys raw materials and pays in cash, it will result in an increase in the company’s inventory (an asset) while reducing cash capital (another the basic accounting equation may be expressed as asset). Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting. The accounting equation helps to assess whether the business transactions carried out by the company are being accurately reflected in its books and accounts. The accounting equation relies on a double-entry accounting system. For example, if a company buys a $1,000 piece of equipment on credit, that $1,000 is an increase in liabilities (the company must pay it back) but also an increase in assets. Similarly, with foreign currency transactions, volatility due to fluctuating exchange rates can significantly change the financial outcome of a deal.

Accounting equation: More examples and explanation

Deskera Books is an online accounting software that enables you to generate e-Invoices for Compliance. It lets you easily create e-invoices by clicking on the Generate e-Invoice button. Assets represent the ability your business has to provide goods and services. Or in other words, it includes all things of value that are used to perform activities such as production and sales.

Why must Accounting Equation always Balance?

This article gives a definition of accounting equation and explains double-entry bookkeeping. We show formulas for how to calculate it as a basic accounting equation and an expanded accounting equation. At first glance, you probably don’t see a big difference from the basic accounting equation.

Liabilities

Conversely, a partnership is a business owned by more than one person, with its equity consisting of a separate capital account for each partner. Finally, a corporation is a very common entity form, with its ownership interest being represented by divisible units of ownership called shares of stock. Corporate shares are easily transferable, with the current holder(s) of the stock being the owners. Earnings give rise to increases in retained earnings, while dividends (and losses) cause decreases.

The balance sheet reports the assets, liabilities, and owner’s (stockholders’) equity at a specific point in time, such as December 31. The balance sheet is also referred to as https://x.com/BooksTimeInc the Statement of Financial Position. As expected, the sum of liabilities and equity is equal to $9350, matching the total value of assets. So, as long as you account for everything correctly, the accounting equation will always balance no matter how many transactions are involved.