What Are the Types of Costs in Cost Accounting?

Any costs directly related to a particular product or service are considered direct costs; examples include raw materials and direct labor. Such costs, therefore, form the core base upon which the exact cost of production is to be calculated and priced appropriately. In addition, cost accounting can also be used as a tool for benchmarking performance against competitors and identifying potential areas of savings. The two main types of cost accounting are activity-based costing (ABC) and traditional costing. ABC assigns costs to activities based on their consumption of resources, whereas traditional costing assigns costs directly to products for manufacturing or services for delivery. Lean cost accounting is a method that aims to streamline production processes to eliminate waste, reduce error, speed up processes, and maximize productivity and profits.

Unlike the Financial Accounting Standards Board (FASB)-driven financial accounting, cost accounting need only concern itself with insider eyes and internal purposes. Management can analyze information based on criteria that it specifically values; that information can then be used to guide how prices are set, resources are distributed, capital is raised, and risks are assumed. In contrast to general accounting or financial accounting, cost accounting is an internally focused, firm-specific method used to implement cost controls. Cost accounting can be much more flexible and specific, particularly when it comes to the subdivision of costs and inventory valuation. Cost-accounting methods and techniques will vary from firm to firm and can become quite complex. When using lean accounting, traditional costing methods are replaced by value-based pricing and lean-focused performance measurements.

Would you prefer to work with a financial professional remotely or in-person?

Compliance with these regulations is paramount but can be complicated, time-consuming, and costly, especially for businesses operating in multiple regions like in Saudi Arabia. It helps them spot unnecessary costs and reduce production-process inefficiencies, improving the business's bottom line. Opportunity cost is the benefits of an alternative given up when one decision is made over another. In investing, it's the difference in return between a chosen investment and one that is passed up.

- A company can use the resulting activity cost data to determine where to focus its operational improvements.

- Under ABC, the trinkets are assigned more overhead costs related to labor and the widgets are assigned more overhead costs related to machine use.

- In the age of competition, the objective of a business is to maintain costs at the lowest point with efficient operating conditions.

- Overhead costs like rent, utility bills, and fixed costs like machinery are examples of indirect costs.

- Cost accounting can be much more flexible and specific, particularly when it comes to the subdivision of costs and inventory valuation.

Direct costs

Operating costs include both the fixed and variable costs that are crucial for the core business operations. It is therefore very important to monitor such costs in order to maintain operational efficiency and profitability. Their duties include everything journal entry for unpaid wages example from planning budgets and monitoring budget performance to setting standard unit costs based on research. They are also expected to assess the operating efficiency of all production activities and departments in an organization.

What is your current financial priority?

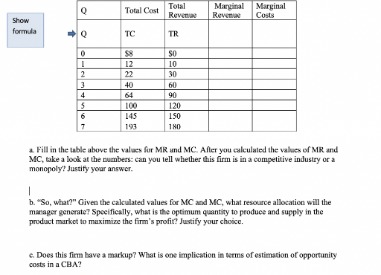

Break-even point analysis is an important tool for price determination on products and services. If the marginal cost of producing one more unit is lower than the market price, the producer is in line to gain a profit from producing that item. This costing method is more useful for short-term decisions as it focuses on variable costs. Fixed costs are still calculated as part of the total cost but they cannot change production cost meaning there is no marginal cost without variable costs.

A cost accountant is a professional tasked by a company to document, analyze and report a company's cost process. It offers a very different take on cost efficiency from traditional methods like activity-based cost accounting. Throughput accounting is a principle-based and simplified management used to create an alignment between all production activities to maximize output. A major advantage of historical cost accounting is that reports are usually considered free of bias and easy to understand. Costs are determined only after they are incurred, and are based on a company's past transactions.

Which activity is most important to you during retirement?

Once throughput is maximized, input and output will flow in the best possible way, allowing companies to reach revenue maximization. Apart from the initial investment, there will be additional finance charges and some other costs necessary to keep the asset operational. Process costing is a costing technique used on cost items that go through multiple production stages. This type of costing aims to know the cost of each stage in the process of producing an item. For example, through cost accounting, you can find out what department is daily sales outstanding overstaffed. You can then decide to lay off the unneeded labor or reassign them to another department if possible.

Accounting cost, also known as explicit cost, refers to the actual expenses a business incurs during its operations, including wages, rent, utilities, and materials. These costs are recorded in financial statements and are essential for determining profitability and budgeting. A direct cost is a cost directly tied to a product's production and typically includes direct materials, labor, and distribution costs. Inventory, raw materials, and employee wages for factory workers are all examples of direct costs. days in inventory Even though cost accounting is commonly called a costing method, the scope of cost accounting is far broader than mere cost. Costing methods determine costs, while cost accounting is an analysis of the different types of costs a company incurs.

The cost-volume-profit analysis is the systematic examination of the relationship between selling prices, sales, production volumes, costs, expenses and profits. This analysis provides very useful information for decision-making in the management of a company. For example, the analysis can be used in establishing sales prices, in the product mix selection to sell, in the decision to choose marketing strategies, and in the analysis of the impact on profits by changes in costs.

It serves, therefore, the purposes of both ascertaining costs and controlling costs. Cost accounting seldom fails a company’s management team and, consequently, the enterprise. Cost accounting systems aim to work out the cost of producing goods and services soon on completion and not long after production.

Best Virtual & Outsourced Accounting Services 2023

The ongoing monthly fee will be based on average monthly business expenses and is $200 for monthly average $0 – $10,000 per month, $300 for $10,001 – $50,000 per month, $400 for $50,001 or more. You’ll also have to pay for a QuickBooks Online subscription on top of that. Online bookkeeping services, also called virtual bookkeeping services, are a very affordable alternative to the traditional employee bookkeeper. To put this in perspective, a bookkeeper’s average salary is $44,527.

How To Choose an Online Bookkeeping Service

Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family. Bookkeeping is an unavoidable part of having a business because the IRS has certain rules around financial recordkeeping. Aside from staying compliant, having organized books helps you monitor the health of your business, prepare for tax time, and prepare key financial statements.

Does your virtual bookkeeper have experience in your industry?

When you have a Small Business Plus plan or higher, you get unlimited online support. All plans come with onboarding, a dedicated bookkeeper and account manager, reconciliation at month-end, balance sheet, P&L, statement of cash flows and a portal with document storage. Higher-tiered plans unlock more transactions and a more frequent service level. Online bookkeeping services can save business owners both time and money.

This is true of any bookkeeper — in person or virtual — that you would hire. It’s especially true of virtual bookkeepers, however, because this will determine if the apps they use to do business are relevant to and compatible with your business. Outsourced, virtual bookkeeping can cost what are audit assertions and why they are important as little as $150 per month and as much as $900 (or more) per month.

With our resources and expert team, you’ll also get a full understanding of IRS requirements for mixing personal and business transactions based on your corporate entity. There are some times that we’ll request documents from you (like account statements or receipts), just to ensure the information we have is correct. If you need to share files with your bookkeeping team, it’s as simple as uploading a file. QuickBooks, Xero and other do-it-yourself bookkeeping software give you a tool to do your own bookkeeping and taxes.

Best for Hiring Certified Bookkeepers

- They are available through the phone in most circumstances, though.

- Or, if it isn’t already included, you may be looking for tax support to take some of the pressure off when it's time to file returns.

- A bookkeeper can also provide you with reports on cash flow or show you what’s going on with your chart of accounts so you can streamline costs and stay on top of your business financials.

Want to learn more about bookkeeping before you sign up for a virtual provider? Our article on business bookkeeping basics gives you more information on how to do bookkeeping and why. Typically, you'd only get detailed financial statements like this through a CFO — which means Merritt gives you some of the best aspects of having a CFO without the high cost. Custom plans make it difficult to predict exactly how much you’ll pay per month. No cap on meetings with your bookkeeper; QuickBooks says small-business owners usually schedule one or two video appointments per month. If you invoke the guarantee, QuickBooks will conduct a full n evaluation of the Live Bookkeeper’s work.

How to Choose Your Online Bookkeeping Services

Live Expert Assisted doesn’t include cleanup of your books or a dedicated bookkeeper reconciling your accounts and maintaining your books for you. Live Expert Assisted also doesn’t include any financial advisory services, tax advice, facilitating the filing of income or sales tax returns, creating or sending 1099s, or management of payroll. We reviewed multiple accounting software options using a detailed methodology to help you find the 9 best online bookkeeping services for small businesses. Our ratings considered everything from pricing and customer reviews to the number and quality of features available and what our panel of experts thought about the services available. There are a lot of different Quickbooks accounting software plans. It advertises a start-from price of $200 but the fine print indicates that the first month of full-service bookkeeping is $500.

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services. No integration with QuickBooks, Xero or other accounting software. Business owners have to use Bench’s proprietary software, which could make it hard to move to another provider in the future.

You also have the option to build a Custom Plan that offers controller support, and fractional CFO services. With their Wave Advisor service, Wave promises to handle your bookkeeping for you, using their free cloud-based accounting software. While pricing starts at $149 per month, it may be difficult to predict how much Wave bookkeeping will cost your business.

Adjusted Total Debt Valuation Adjustment

Debt-adjusted cash flow (DACF) is commonly used to analyze oil companies and represents pre-tax operating cash flow (OCF) adjusted for financing expenses after taxes. Adjustments for exploration costs may also be included, as these vary from company to company depending on the accounting method used. By adding the exploration costs, the effect of the different accounting methods is removed.

DACF is useful because companies finance themselves differently, with some relying more on debt. For example, Pfizer (PFE) had a total of $45 billion in adjusted total debt removed from shareholder value. This includes its $31 billion fair value of long-term debt, $6 billion in fair value short-term debt, and its $1 billion in off-balance sheet debt.

This is the most common metric used for any type of financial modeling valuation. In other words, it reflects cash that the company can safely invest or distribute to shareholders. If a company’s sales are struggling, they may choose to extend more generous payment terms to their clients, ultimately leading https://bookkeeping-reviews.com/ to a negative adjustment to FCF. A company could have diverging trends like these because management is investing in property, plant, and equipment to grow the business. In the previous example, an investor could detect that this is the case by looking to see if CapEx was growing between 2019 and 2021.

A negative net debt implies that the company possesses more cash and cash equivalents than its financial obligations and is hence more financially stable. We just noted that the ratio can be calculated using either cash flow from operations or free cash flow. Free cash flow deducts cash expenditures for ongoing capital purchases, which can greatly reduce the amount of cash available to pay off debt. The 20% outcome indicates that it would take the organization five years to pay off the debt, assuming that cash flows continue at the current level for that period. When evaluating the outcome of this ratio calculation, keep in mind that it can vary widely by industry.

- Enterprise Value to Debt-Adjusted Cash Flow (EV/DACF) is one such measure.

- The value of a project financed with debt may be higher than that of an all equity-financed project since the cost of capital often decreases with leverage, turning some negative NPV projects into positive ones.

- They acknowledge that these statements offer a better representation of the company's operations.

- Although the effort is worth it, not all investors have the background knowledge or are willing to dedicate the time to calculate the number manually.

- A debt free cash flow calculation can help guide smarter debt management decisions and avoid knee-jerk reactions to interest rate fluctuations.

Free Cash Flow to Equity can also be referred to as “Levered Free Cash Flow”. This measure is derived from the statement of cash flows by taking operating cash flow, deducting capital expenditures, and adding net debt issued (or subtracting net debt repayment). The cash flow-to-debt ratio examines the ratio of cash flow to total debt. Analysts sometimes also examine the ratio of cash flow to just long-term debt.

Debt Free Cash Flow

A basic understanding of these widely-used multiples is a good introduction to the fundamentals of the oil and gas sector. The energy sector comprises of oil and gas, utilities, nuclear, coal, and alternative energy companies. But for most people, it's the exploration and production, drilling, and refining of oil and gas reserves that make the energy sector such an attractive investment. Let’s say that we have $10,000 of annual interest expense on $167,000 of interest bearing debt implying an annual interest rate of 6%. Now let’s assume management wants to reduce the annual interest expense by $3,000.

- To limit the effects of volatility, a 30-day or 60-day average price can be used.

- T. Rowe Price’s Traditional FCF to Debt ratio rose from 10.5 in 2020 to 11.1 TTM, while its Adjusted FCF to Debt ratio fell from 9.9 to 9.6 over the same time.

- David is a distinguished investment strategist and corporate finance expert.

- EV/DACF takes the enterprise value and divides it by the sum of cash flow from operating activities and all financial charges.

Calculate the value of the unlevered firm or project (VU), i.e. its value with all-equity financing. To do this, discount the stream of FCFs by the unlevered cost of capital (rU). Reliable fundamental data to provide unconflicted insights into the fundamentals and valuation of private and public businesses. Figure 7 shows the differences between the two components of the FCF to Debt ratio, 3-year average FCF and total debt for Monolithic Power Systems (MPWR). The difference between Monolithic Power Systems’ Traditional 3-Year Average FCF and Adjusted 3-Year Average FCF is -$108 million, or 499% of Traditional 3-Year Average FCF.

How to Define Good Free Cash Flow

Investors who wish to employ the best fundamental indicator should add free cash flow yield to their repertoire of financial measures. As an example, the table below shows the free cash flow yield for four large-cap companies and their P/E ratios in the middle of 2009. Apple (AAPL) sported a high trailing P/E ratio, thanks to the company's high growth expectations. General Electric (GE) had a trailing P/E ratio that reflected a slower growth scenario.

Share this chapter

This report is one of a series on the adjustments we make to GAAP data so we can measure shareholder value accurately. This report focuses on an adjustment we make to our calculation ofeconomic book value and our discounted cash flow model. Gross debt is the nominal value of all of the debts and similar obligations a company has on its balance sheet. If the difference between net debt and gross debt is large, it indicates a large cash balance along with significant debt, which could be a red flag. Net debt removes cash and cash equivalents from the amount of debt, which is useful when calculating enterprise value (EV) or when a company seeks to make an acquisition. This is because a company is not interested in spending cash to acquire cash.

To find the unlevered cost of capital, we must first find the project’s unlevered beta. Unlevered beta is a measure of the company’s risk relative to that of the market. It is also referred to as “asset beta” because, without leverage, a company’s equity beta is equal to its asset beta. Net debt is a liquidity metric used https://kelleysbookkeeping.com/ to determine how well a company can pay all of its debts if they were due immediately. Net debt shows how much debt a company has on its balance sheet compared to its liquid assets. Adjusted Total Debt provides a more complete view of the fair value of a firm’s total short-term, long-term, and off-balance sheet debt.

Advantages of EV/EBITDA

This would tell us how many years it would take the business to pay off all of its debt if it were to devote all cash flow generated from operations to repaying debt. Investors are interested in what cash the company has in its bank accounts, as these numbers show the truth of a company's performance. It is more difficult to hide financial misdeeds and management adjustments in the cash flow statement. It removes the major non-cash charges (depreciation and amortization), the financing aspect (interest), and taxes. FCFE is good because it is easy to calculate and includes a true picture of cash flow after accounting for capital investments to sustain the business. The downside is that most financial models are built on an un-levered (Enterprise Value) basis so it needs some further analysis.

After reviewing Figures 1 and 2, I am not surprised to see in Figure 3 how much higher the Traditional FCF to Debt ratio is compared to the Adjusted version. In the TTM, the Traditional FCF to Debt ratio is more than twice the Adjusted FCF to Debt ratio. Figure 1 shows the difference between Traditional 3-Year Average FCF and my Adjusted 3-Year Average FCF since 2016. Over the TTM, Traditional https://quick-bookkeeping.net/ 3-Year Average FCF is overstated by $689 billion, or 51% of the Traditional 3-Year Average FCF. This report will show how FCF to Debt ratings for 54% of S&P 500 companies are misleading because they rely on unscrubbed data. The fact is, the term Unlevered Free Cash Flow (or Free Cash Flow to the Firm) is a mouth full, so finance professionals often shorten it to just Cash Flow.

Analysts may look at debt-adjusted cash flow to help in fundamental analysis or generate valuation metrics for a company's shares. Enterprise Value to Debt-Adjusted Cash Flow (EV/DACF) is one such measure. Enterprise value (EV) is a measure of a company's total value, often used as a more comprehensive alternative to equity market capitalization. That is why many times it is more effective and less costly to grow the firm relative to over-all debt financing rather than consciously paying it down in the short term.

What are Key Business Drivers and How Can You Identify Them The American Society of Administrative Professionals

Especially those that contribute to product sales, marketing, production, and development. A company’s strategy business driver definition and goals are dependent on the business drivers it identifies, and their order of importance. Internal benchmarking is quite straightforward, as you will be gauging your current performance against past figures. You can identify patterns and get facts from historical figures which should help you identify problem areas as well as opportunities for growth. A thorough analysis of the present, as measured against the past, should help you identify your key drivers.

Supercharge your skills with Premium Templates

Even as you go through analyzing your financial statements, asking the right questions and using benchmarks, always remember to refer back to the criteria already highlighted. Before settling on any factor as a driver, ensure that it fits the criteria. You will want to make your drivers very specific, this way, they will easily fit into the above criteria. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

Reporting on business drivers

Business drivers can be used in many ways to help a company stay competitive and achieve its desired results. They can be used to identify and respond to changes in the marketplace, formulate strategies, and make informed decisions. The quest for long-term business value starts with a clear understanding of the variables that actually create value in a significant way, which are the key business value drivers. And these drivers in order for them to be useful, they must be controllable or at least manageable to a certain degree. Consider, for instance, the number of stores, identified earlier as a key driver.

Even with scrutinizing your financial statements, it all comes down to asking the right questions. When you are not looking at these statements and carrying out an analysis of the same, you can ask the right people to get more insights. This calculator uses the Effective Annual Rate (EAR) to accurately compute the interest rate per payment period when your payment frequency differs from the interest compounding frequency. In a law firm, for example, thoroughness is much more important than speed of delivery. We must accept some drivers as necessary evils because we cannot control them.

- How many visitors come to the company’s website is also a business driver.

- They can also help management identify and respond to changes in the marketplace, so they can formulate strategies to achieve their desired results.

- You will want to make your drivers very specific, this way, they will easily fit into the above criteria.

- A company’s strategy and goals are dependent on the business drivers it identifies, and their order of importance.

- You can identify patterns and get facts from historical figures which should help you identify problem areas as well as opportunities for growth.

Identifying Your Business Drivers

When building a financial model in Excel, the process begins with building an assumptions section, which includes all the main business drivers. Once these inputs are all in place, a forecast can be built and a basic three-statement model can be created. That’s why your goal should be to prioritize business drivers that best serve your organization. But identifying key behaviors will help you define your leadership culture.

And they’re the first step to identifying and prioritizing the key skills you want to build in any leadership development program. One of the biggest barriers to successful leadership development is a missing link between the skills leaders are learning and the business context. A solid understanding of what drives your business is crucial, as you’ll need them as inputs when developing your business strategy and building a financial model. Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

Advanced modeling such as sensitivity analysis, financing structures, and transactions such as mergers and acquisitions (M&A) can also be done. Take your learning and productivity to the next level with our Premium Templates. Access and download collection of free Templates to help power your productivity and performance. Drivers vary significantly by industry, but they can all be determined using the same type of root cause analysis. In this visual guide presented by our affiliate channel, Marketing Business Network on YouTube, we explain what a “Business Driver” is using straightforward language and easy-to-understand examples.

Decision Making Framework: A Guide to Smarter Choices

But if a team is working together through a suggestion, Shklarski suggests writing it on a whiteboard or in a Google Doc that everyone can see and collaborate. As COO of Stripe, Claire Hughes Johnson has developed a decision-making framework that has become a sort of shared decision-making compass for all members of the team, new and old. According to Johnson, you need to document concrete core tenets describing the way you work. When a startup team is small and more or less in sync, most choices can be decided by the founding team.

The Eisenhower Matrix

They were wary of the high pressure connected with decision-making and negotiating these decisions with colleagues. This decomposition allows us to see that the solution variation “Public transport” doesn’t provide any benefits. Despite its pros, the option “Airplane” can’t be considered as the Traveler is afraid to fly.

What Are Decision-Making Frameworks And Why Are They Important?

Preliminaries The fuzzy set theory was introduced by Zadeh in 1965 to represent the degree of elements belonging to particular sets. Generally, a specific membership function represents fuzziness in a particular fuzzy set toward a unique model performance (Arslan & Kaya, 2001). The three most popular curves are triangular, trapezoidal, and Gaussian (Rutkowska, 2016).

Decision Matrix

Fulfilling decarbonised resilient CLSC under disruptions is a target for organisations and researchers alike. For instance, Yavari and Zaker (2019) proposed a multi-layer mathematical model of green CLSC resilience to minimise the cost and carbon emissions considering unexpected events. Later, Mehrjerdi and Shafiee (2021) combined a mathematical model and fuzzy TOPSIS to optimise three dimensions of a sustainable CLSC resilience network under electrical disruption in perishable product companies. Similarly, Akbari-Kasgari et al., (2022) developed a model of sustainable CLSC resilience under disruption of earthquakes in mines to control profit, water utilisation, carbon footprint and unemployment rate. Consequently, studying the theoretical framework of decarbonised resilient CLSC networks under different disruptions (Fig. 1) is a significant modern demand in the extant literature.

Leverage Data and Analytics

Furthermore, excluding Paul et al., (2022) and Badhotiya et al., (2022), other scholars have applied crisp data in a certain environment. Albeit, uncertainty is an inseparable part of the socioeconomic environment. In this domain, fuzzy logic is an authentic theory that struggles with this vagueness (Razavi Hajiagha et al., 2021). In contrast, some others suggest that the pharmaceutical industry would be significantly affected by the supply disruption caused by COVID-19. Thus, investigating the decarbonised resilient CLSC criteria of Iran's pharmaceutical SMEs needs to be considered in the era of the COVID-19 outbreak. The extant body of literature is systematically reviewed in the next section to extract an initial categorised list of decarbonised resilient SCs criteria impacted by the COVID-19 outbreak.

- Remember, though, that no technique can substitute for good judgement and clear thinking.

- For example, “think rigorously” is paramount for high impact and irreversible decisions, but “move with urgency” is critical for decisions that are lower impact and potentially tunable.

- When you want to decide which shirt to wear, you’re better off closing your eyes and pointing.

- Although they are very similar concepts, they have very different applications in project management and, as a result, achieve very different goals.

- Because founders Larry and Sergey were (and are) very strong-minded leaders involved in every major decision, Eric knew he couldn’t make huge unilateral choices.

Root Cause Analysis

Decision-making often involves dealing with uncertainty and inherent risks. To address this challenge, decision-makers can employ techniques such as scenario analysis, risk assessment, and considering multiple perspectives to mitigate potential risks. During the evaluation process, it is beneficial to conduct scenario analysis to understand how each option may play out under different circumstances.

S.P.A.D.E - Setting, People, Alternatives, Decide, Explain

A thorough assessment of current digital capabilities and processes is essential. Businesses need to understand their existing technology landscape, skill sets, and cultural readiness for change. Identifying gaps between decision framework example the current state and the desired future state allows for the prioritization of efforts and resources. This step helps in pinpointing the areas that require immediate attention and sets a baseline for measuring progress.

RACI Decisions

Moreover, the importance of these three factors rose to the second tier. Notably, another industrial metric (CRI) shifted into the linkage category, exhibiting higher dependency (13) while maintaining the same level of influence (10). This shift highlights the potential for an expansive communication network post-crisis, attributed to the lifting of relationship and trade restrictions. Regarding phase (a), the TAs has the greatest impact with a rating of 11, followed closely by both industrial (MRI and CRI) and economic dimension (RMM), both having a high causality rating of 10. However, the internal system slightly impacts them, ranging from 1 to 2 degrees. These issues align with previous research (Duan et al., 2021), which confirms that the material flow of decarbonised resilient CLSCs is vulnerable and affects capital and information flows.

Nonetheless, cause-and-effect interactions of such criteria and their priority have not yet been discussed. However, quantitative methodologies have been mostly limited to mathematical programming models and simulation. That is embedded with multi-scenario analyses under uncertainty and experts' views.

Solved: Know Your Client template and Client onboarding templates

Before having the client set up QuickBooks Online, having a meeting to establish which types of reporting they need means that you can get them set up on the right version from the outset. This would be good for those just starting the business with no accounting yet. For those who already have business ongoing, you'll also need your open invoices and bills. I would add any loan accounts and potentially any fixed assets, especially if the company is not a "new" company, just new to QB.

Free Webinars for Accountants

So start with the basic, simple questions to help you understand what they deal with. Let the client what is the difference between revenues and earnings tell you their business name, address, and industry or nature of business. You can access accounts, previous accounting systems, and inventory records through the communications system. Knowing the taxation and reviewing previous invoices, financial statements, or documents can also be easier. If you're planning to develop a new bookkeeping client checklist for onboarding, this guide is for you, as we’ll delve deeper into that and much more. If you’re looking for a more robust way to track projects, deadlines, and tasks across your team, check out Jetpack Workflow with a free 14 day trial here.

This gives your clients a better experience, and helps you grow from small business owner to effective team manager as you add more staff. You can make a new client checklist for accountants after knowing the size of the company and its structure. After that, you should create the best steps you want your new bookkeeping client checklist to have, like individual tasks. You will probably need to assist with linking accounts to your client’s QuickBooks.

Step 8: Review the chart of accounts with the client to verify that the accounts meet the clients and your needs.

- This powerful accounting software allows you to monitor and analyze your clients' financial transactions, account balances, and reports as they happen.

- Once you’ve set up the chart of accounts, you should import the initial set of data and review the output with the client prior to importing several years of data.

- Implementing a clear client communication strategy will ensure effective client relationship management and help you build trust with your clients.

It’s designed to make every client engagement easier, from tasks like the onboarding of clients to building timely reports. Once you’ve set up the chart of accounts, you should import the initial set of data and review the output with the client prior to importing several years of data. This allows you to fix any expense categories and give the client a sample output long-term assets definition and meaning to review.

Step 2: Determine whether the client will need QuickBooks payroll services.

However, doing so means that you will spend significantly less time on data entry and will provide more efficient and accurate bookkeeping services. The bank feeds provide a complete picture of the transactions in the bank, although they need to be reviewed for accuracy through regular reconciliations. The success of the onboarding with a new bookkeeping client checklist project depends on how collaborative the team members are during the processing. To make work easier for your team members when onboarding a client, introduce the best collaborative tool that makes communication easier. When developing the bookkeeping onboarding checklist, ensure you know your client's expectations or goals. Let the client also understand your perspective on a successful project and give them time to share their view.

Training

You need to make sure these payments and deposits are not incorrectly entered as income or expenses. Are you ready to streamline your accounting processes to provide a better experience for your clients? This powerful accounting software allows you to monitor and analyze your clients' financial transactions, account balances, and reports as they happen.

They didn't tell me I would never get the money once they took it from my client. Have communications plans for a new client checklist for bookkeepers to enable you to deliver with fewer challenges. Create a project-specific communication system that your team members and clients can access without challenges. This meeting can be done virtually or in person, but having a kickoff meeting will allow you to discuss the company’s financial structure. The discussion should include the number of bank accounts, credit cards, and loans that the company has. Like evaluating the client’s reporting needs, this step can help you get them set up right from the start.

Implementing a clear client communication strategy will ensure effective client relationship management and help you build trust with your clients. QuickBooks Online and QuickBooks Online for Accountants both have Canadian versions, but they are some differences between regions. It's vital that you have the correct product to suit the needs of your business as well as your client companies. QuickBooks Online Accountant is a great tool able to help you have access to your client's books from anywhere with an internet connection so you can help them with their bookkeeping.

Then come to a common agreement on goals to make the project successful. Many small business owners find QuickBooks intimidating which is where your bookkeeping services come in. Start by collecting all your client’s financial expense recognition principle data, including past accounting software files, spreadsheets, bank statements, invoices, and expenses. Ensure all of their financial data is accurately migrated or converted to your client’s QuickBooks Online account. New business owners DO NOT use QB for invoicing or processing credit cards from clients.

If your client is using a third-party to run payroll, you can skip this step. However, having it in your standard workflow will ensure that you have the conversation with your client as you go through the onboarding process. The bookkeeping client onboarding questionnaire is like an interview where you want to know more about the customer.

QuickBooks Online vs Desktop: Which Is Right for Your Business?

QuickBooks Desktop Enterprise has the same great accounting capabilities as Pro and Premier but allows access for up to 40 users and much more storage space. QuickBooks Enterprise has highly developed features to meet the needs of nearly any large business. QuickBooks Enterprise also offers much better customer support than QuickBooks Pro or QuickBooks Online with its Priority Circle customer support. As a QuickBooks ProAdvisor, Mark has extensive knowledge of QuickBooks products, allowing him to create valuable content that educates businesses on maximizing the benefits of the software. This requires the software to allow users transitioning from other bookkeeping software to import their chart of accounts (COA), vendors, customers, service items, and inventory items. Ideally, there will be a wizard to walk the user through the import process.

QuickBooks Online offers a large selection of reports, but they aren’t industry-specific. Since QuickBooks Online is priced as a monthly subscription, it doesn’t require a contract and you can cancel your account at any time. Additionally, the desktop products are only available as annual subscriptions, making them a bigger commitment than QuickBooks Online. Businesses that have purchased one-time licenses of the locally-installed QuickBooks Desktop versions that have been sunset can still use the software’s accounting features. However, these versions don’t receive security updates, live support, or access to cloud-based services such as live bank feeds, QuickBooks Desktop Payments, or QuickBooks Desktop Payroll. QuickBooks Desktop still has a place in the accounting software industry.

See why more businesses are choosing QuickBooks Online

- With QuickBooks Online, users receive many of the same great features while gaining the mobility of cloud-based software.

- The application also offers a mobile app that works with both iOS and Android devices.

- While both software types have plenty of perks, QuickBooks Online is a more flexible, affordable, and scalable option for most small-business owners.

- In other words, Mac users can't scale up their software from one plan to the next as they add software users.

To purchase understanding your pay statement QuickBooks Desktop Pro, you will need to contact QuickBooks Sales by phone. QBO offers up to 25 full-fledged users total and an unlimited number of time-tracking-only users. This includes the availability of integrations for payroll, time tracking, and receiving e-payments. We also evaluated whether an electronic bill pay integration was available.

Online Plus and Payroll Core Bundle

While both software types have plenty of perks, QuickBooks Online is a more flexible, affordable, and scalable option for most small-business owners. QuickBooks Desktop doesn't offer the same multi-user accessibility, but it does have a more comprehensive assortment of features that provide an in-depth view of your accounting operations. QuickBooks Desktop offers more advanced inventory management features, job costing worksheets, sales orders, and highly customizable reports. I was impressed with how you could do batch invoicing, something QuickBooks Online doesn't offer.

QuickBooks Online vs. QuickBooks Desktop: Which Is Better for Your Business?

A new and improved migration process gives you even more ways to move online. Move from any version of QuickBooks Desktop, and only migrate the data that matters most to you. Keep in mind that if you do decide to have QuickBooks Desktop hosted, there will be an additional fee.

Though there are occasional navigation difficulties, QBO is incredibly easy to use overall. QuickBooks Desktop is preferable for companies wanting to manage their books without an internet connection. It’s also the better option for businesses requiring complex inventory accounting features. mompreneurs We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers.

If you choose to cancel your QuickBooks Online subscription, you will still have access to your QuickBooks Money account and data. With QuickBooks Desktop, users receive some of the most developed accounting tools on the market. The software offers comprehensive features, unique touches (such as lead management and sales orders), industry-specific versions of the software, and the potential to be more secure. Not only is QuickBooks Online easier to use, but it offers additional support — for a fee. QuickBooks Online users can sign up for QuickBooks Live Bookkeeping to assist with getting the books up to date and managing bookkeeping tasks.

Fit Small Business Case Study

While there are significant differences between QuickBooks Desktop and QuickBooks Online, both applications offer solid accounting capability for small businesses. And while QuickBooks Desktop comes out on top in this comparison, only you can decide which one is best for your business. If neither application catches your eye, why not take a look at some QuickBooks alternatives or check out The Ascent's accounting software reviews. QuickBooks Online and QuickBooks Desktop are both excellent small business accounting software applications, both offering complete double-entry accounting as well as automatic processing of closing entries.

There are six QuickBooks versions that allow business owners to manage their accounting and finances. Each QuickBooks product varies in price, features, usability, and target audience. Even after initial setup, the setting up the zip software must also let users modify information like company name, address, entity type, fiscal year-end, and other company information. One big drawback of QuickBooks Pro in the past was that it didn’t have mobile apps. Fortunately, a mobile app is now available with the introduction of QuickBooks Desktop 2022.

If you can’t decide between two programs, here’s how they stack up head-to-head to help you determine which version of QuickBooks is the best accounting solution for your business. This table takes a deep look into each program’s features, so you’ll know exactly what each version of QuickBooks is capable of. Comparing QuickBooks features is one of the best ways to decide which version of the software is the best fit for your business.

Oregon State Income Tax: Rates and Who Pays in 2023-2024

This means that when you make purchases in Oregon, you won’t be charged a state-level sales tax on most goods and services. Enjoy easy and hassle-free tax filing services for any filing status (single or joint) across all 50 states with Beem. If you spent the entire tax year living outside Oregon and are not an Oregon resident, you are only required to pay Oregon income tax on income earned from sources within Oregon. Keep in mind that this estimator assumes all income is from wages, assumes the standard deduction, and does not account for tax credits. Oregon has four marginal tax brackets, ranging from 4.75% (the lowest Oregon tax bracket) to 9.9% (the highest Oregon tax bracket).

It’s also worth noting that the IRS made major revisions to the W-4 in recent years. The new form doesn't let filers claim allowances anymore, nor are personal or dependency exemptions allowed. This new W-4 now includes a five-step process that allows you to indicate any additional income or jobs, as well as other pertinent personal information. The corporate excise and income tax is the second largest source of state tax revenue for the General Fund. Corporations that do, or are authorized to do, business in Oregon pay an excise tax. Corporations not doing, or that are not authorized to do, business in Oregon, but have income from an Oregon source, pay income tax.

Where is My Oregon State Income Tax Refund?

The Personal Exemption, which is supported by the Oregon income tax, is an additional deduction you can take if you (and not someone else) are primarily responsible for your own living expenses. Likewise, you can take an additional dependent exemption for each qualifying dependent (like a child or family member), who you financially support. Taxable property includes real property, mobile homes and some tangible personal property used by business. The state and each county assessor determine the value of property in each county. Measure 5, which was passed by the voters in November 1990, restricted non-school taxes on any property to $10 per $1,000 of real market value. It restricted school taxes on any property to $5 per $1,000 of real market value.

Whether or not you have to pay Oregon state income tax depends on your residency status and the source of your income. Oregon residents are taxed on taxable income from all sources, while nonresidents are taxed on their income from Oregon sources. Oregon has a state income tax system, so knowing their tax regulations and requirements is vital, especially if you are a resident or doing business here. The state follows specific guidelines for individual and business tax returns. Therefore, understanding Oregon’s state income tax system is essential to ensure compliance with tax obligations and to avoid any issues.

How do Oregon tax brackets work?

Hunter Biden subsequently pleaded not guilty to the two misdemeanor offenses related to his filing of federal income taxes. That previous indictment alleges that Hunter Biden did not pay federal income taxes for either 2017 or 2018, despite owing more than $100,000 in taxes each year. Exactly how much your employer deducts from your wages for federal income taxes depends on factors like your marital status, salary and whether you have any dependents.

- But what do these numbers mean, and who else might be affected by Oregon’s income tax rates?

- For example, say you want to withhold an additional $25 each month.

- The portion of your paycheck that goes to taxes in Oregon varies depending on your income level and deductions.

- For all of the tax forms we provide, visit our Oregon tax forms library or the 's tax forms page.

It consists of four income tax brackets, with rates increasing from 4.75% to a top rate of 9.9%. That top marginal rate is one of the highest rates in the country. Only a small subset of taxpayers actually pays that rate, however, as it applies only to single taxpayers making at least $125,000 a year ($250,000 for joint filers). The table below shows the full tax brackets and rates for the state income tax in Oregon. In most cases, you must make estimated tax payments if you expect to owe $1,000 or more when you file your oregon income tax return.

Corporate Tax Rates around the World, 2023

Oregon Capital Chronicle focuses on deep and useful reporting on Oregon state government, politics and policy. We help readers understand how those in government are using their power, what’s happening to taxpayer dollars, and how citizens can stake a bigger role in big decisions. It is not intended to provide financial, legal or accounting advice and should not be relied on for the same. Please consult your own financial, legal and accounting advisors before engaging in any transactions. In 1862, not long after joining the Union, Oregon enacted a tax on people of color. If you were Black, mixed-race, Hawaiian, or Chinese, you had to pay a tax not levied on white Oregonians.

Oregon tax kicker 2023: How to calculate your tax kicker - Statesman Journal

Oregon tax kicker 2023: How to calculate your tax kicker.

Posted: Mon, 09 Oct 2023 07:00:00 GMT [source]

3 6 Prepare a Trial Balance Principles of Accounting, Volume 1: Financial Accounting

After the unadjusted trial balance is prepared and it appears error-free, a company might look at its financial statements to get an idea of the company’s position before adjustments are made to certain accounts. A more complete picture of company position develops after adjustments occur, and an adjusted trial balance has been prepared. These next steps in the accounting cycle are covered in The Adjustment Process.

While this may be confusing at first, and it may be tempting to simply use positive and negative numbers to account for transactions, ultimately the debit and credit relationship more accurately expresses what happens in a business. A general ledger acts as a record of all of the accounts in a company and the transactions that take place in them. Balancing the ledger involves subtracting the total number of debits from the total number of credits. In order to correctly calculate credits and debits, a few rules must first be understood. Although each account has a normal balance in practice it is possible for any account to have either a debit or a credit balance depending on the bookkeeping entries made. Because the balances in the temporary accounts are transferred out of their respective accounts at the end of the accounting year, each temporary account will have a zero balance when the next accounting year begins.

Bookkeeping

Asset, liability, and most owner/stockholder equity accounts are referred to as permanent accounts (or real accounts). Permanent accounts are not closed at the end of the accounting year; their normal balance of accounts balances are automatically carried forward to the next accounting year. Accounts Receivable is an asset account and is increased with a debit; Service Revenues is increased with a credit.

- These credit balances would transfer to the credit column on the unadjusted trial balance.

- The trial balance report lists all balance sheet and income statement summary accounts with account numbers and descriptions.

- This meant they would review statements to make sure they aligned with GAAP principles, assumptions, and concepts, among other things.

- The trial balance is prepared after the subsidiary journals and journal entries have been posted to the general ledger.

- Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

- After preparing your trial balance this month, you discover that it does not balance.

Software for automating accounting for payables and supplier invoice processing and making efficient and cost-efficient global mass payments helps your company achieve competitive advantages. Income statement accounts include Revenues, Cost of Goods Sold and Cost of Services, Expenses, gains, and losses. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. Unfortunately, you will have to go back through one step at a time until you find the error. Debit simply means on the left side of the equation, whereas credit means on the right hand side of the equation as summarized in the table below.

How To Clear Undeposited Funds In Quickbooks Online

This will open the bank deposit form where you can enter the details of your deposit. On this form, you will see fields for the date, deposit to account, payment method, and reference number. Fill in these fields accurately to reflect the specific details of your deposit.

Step 2: Review and Organize your transactions

From the Sales receipt form, you’ll need to provide the requested details. Suppose we recently received an upfront payment of $150 in cash from Robert Allard for an A/C repair service. Record the payment received from your customer and place it into the Undeposited Funds account. Use the Receive payment form when your customer pays you for an invoice and the Sales receipt form when you receive immediate payments. If your bank records a single payment as its own deposit, you don’t need to combine it with others in QuickBooks. Instead, you can put the payment directly into an account and skip Undeposited Funds.

Using this Undeposited funds feature is going to be an important part of your workflow if you use an external processing what is the role of capital market in economic development service or have some wait time depositing your money. It’s good to periodically check your Undeposited Funds account and clear out any payments waiting to be moved. Here’s how to put payments into your Undeposited Funds account before you combine them. Here’s how to put payments into your Undeposited Funds account. When you deposit the payments together at the bank, you record that in QuickBooks as well.

Adding a Payment to a Deposit

This ensures that all the payments you want to clear are accounted for and properly classified before you proceed with creating a bank deposit. Undeposited funds are a temporary account in QuickBooks Online that acts as a holding account for customer payments received but not yet deposited into your bank account. When you receive a payment from a customer, QuickBooks automatically assigns it to the undeposited funds account, rather than directly to your bank account. In some cases, you may encounter a situation where some payments remain uncleared or unmatched. These payments might be the result of errors, duplicates, or intentionally left out of the bank deposit.

- This gives you better control over your cash flow and streamlines your bookkeeping process.

- Review your deposits to verify that the amounts recorded accurately reflect the total funds you deposited into your bank account.

- For example, let’s say Willie’s Widgets paid you $300, Wally’s Whatsits paid you $750 and Whitley’s Whosits paid you $200.

- Welcome to our guide on how to clear undeposited funds in QuickBooks Online.

In such cases, take the necessary time to reconcile and resolve the discrepancies to ensure accurate financial records. When you’re ready to clear undeposited funds, you will create a new bank deposit in QuickBooks Online. When you have your deposit slip, make a bank deposit in QuickBooks to combine payments in Undeposited Funds to match. This two-step process ensures QuickBooks always matches your bank records. As you verify the clearance of undeposited funds, it’s advisable to cross-reference the cleared payments with your bank statement or transaction history. This ensures that the records in QuickBooks working capital turnover ratio Online align with the actual deposits made in your bank account.

QuickBooks for Small Business: Which Version Do You Need?

If you process invoice payments through QuickBooks Payments for Desktop, QuickBooks takes care of everything for you. For example, if you need to provide additional information or notes about the deposit, like the source of the funds, you can add those details in the memo or notes section of the transaction. Whether you are new to QuickBooks Online or looking to optimize your bookkeeping workflow, this guide will equip you with the knowledge and tools to effectively manage and clear undeposited funds. It’s a good idea to check your Undeposited Funds account to clear out any payments waiting to be deposited. Use it to hold all payments you need to combine and group together. You'll decide which account in QuickBooks to put the deposit into when you combine.

Undeposited funds are a convenient feature in QuickBooks Online that allows you to group together multiple payments before recording a bank deposit. This gives you better control over your cash flow and streamlines your bookkeeping process. However, it’s important to regularly clear undeposited funds to ensure that your records are accurate and up to date. Now that you have reviewed and finalized the bank deposit details, it’s time to record the deposit in QuickBooks Online. This step ensures that the funds are accurately reflected in your bank account and that your financial records are up to date. After selecting the payments to include in the bank deposit, it’s crucial to review and finalize the deposit details before proceeding.

You’ll also notice that when you click on the deposit, it expands and you can choose to edit. This is the convenience of this special account I know you’ll learn to love. You don’t need to do this if you’re downloading transactions directly from your bank. If you use account categories or tags in your QuickBooks Online account, make sure to assign the appropriate categories or tags to the transaction to maintain consistency and ease of reporting. The options (Save, Print, Email the Sales Receipt) are in the ribbon, so you can choose whether you want to print or email the sales receipt immediately or in a batch later on.

Learn how to put payments into the Undeposited Funds account before you combine them into a deposit. When the deposit clears the bank, you will be able to match the deposit in your bank feed. If you don’t use the bank feed function in QuickBooks Online, you will still be able to easily reconcile the deposit when you get your bank statement. Again, make sure you are selecting Undeposited Funds from the “Deposit To” drop-down menu, and save the transaction.

Many, how to create a powerful brand identity or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Have you ever been in your Chart of Accounts and noticed Undeposited Funds? It’s possible that you’ve seen it many times without knowing much about it, or when you should use it. Well, get ready to learn something new and take a thorough look at Undeposited Funds.