What is FIFO? First In, First Out Method Explained

Suppose the number of units from the most recent purchase been lower, say 20 units. We will then have to value 20 units of ending inventory on $4 per unit (most recent purchase cost) and the remaining 3 units on the cost of the second most recent purchase (i.e., $5 per unit). Therefore, the value of ending inventory is $92 (23 units x $4), which is the same amount we calculated using the perpetual method.

The FIFO Method: First In, First Out

Sal’s Sunglasses is a sunglass retailer preparing to calculate the cost of goods sold for the previous year. But when using the first in, first out method, Bertie’s ending inventory value is higher than her Cost of Goods Sold from the trade show. This is because her newest inventory cost more than her oldest inventory. As a result, ABC Co's inventory may be significantly overstated from its market value if LIFO method is used.

How to calculate COGS using FIFO?

Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business balance sheet owners. On 2 January, Bill launched his web store and sold 4 toasters on the very first day. Bill sells a specific model of a toaster on his website for $12 apiece.

Why is FIFO the best method?

- This article breaks down what the FIFO method is, how to calculate FIFO for your store and the key differences from LIFO.

- Then, the remaining inventory value will include only the products that the company produced later.

- All pros and cons listed below assume the company is operating in an inflationary period of rising prices.

- The FIFO method avoids obsolescence by selling the oldest inventory items first and maintaining the newest items in inventory.

- But when it was time to replenish inventory, her supplier had already increased their prices.

- A higher COGS can lower your gross profit, which in turn, can lower your taxable income.

The FIFO valuation method generally enables brands to log higher profits – and subsequently higher net income – because it uses a lower COGS. As mentioned above, inflation usually raises the cost of inventory as time goes on. This means that goods purchased at an earlier time are usually cheaper than those same goods purchased later. At the end of her accounting period, she determines that of these 230 boxes, 100 boxes of dog treats have been sold. It’s important to note that the FIFO method is designed for inventory accounting purposes. In many cases, the inventory that’s received first isn’t always necessarily sold and fulfilled first.

We’ll also compare the FIFO and LIFO methods to help you choose the right fit for your small business. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support. As can be seen from above, the inventory cost under FIFO method relates to the cost of the latest purchases, i.e. $70. Because the value of ending inventory is based on the most recent purchases, a jump in the cost of buying is reflected in the ending inventory rather than the cost of goods sold.

When sales are recorded using the LIFO method, the most how to calculate using fifo recent items of inventory are used to value COGS and are sold first. In other words, the older inventory, which was cheaper, would be sold later. In an inflationary environment, the current COGS would be higher under LIFO because the new inventory would be more expensive.

- The remaining two guitars acquired in February and March are assumed to be unsold.

- You can use our online FIFO calculator and play with the number of products you sold to determine your COGS.

- The remaining unsold 675 sunglasses will be accounted for in “inventory”.

- Rather, every unit of inventory is assigned a value that corresponds to the price at which it was purchased from the supplier or manufacturer at a specific point in time.

- As a result, inventory is a critical component of the balance sheet.

- The only reason for this is that we are keeping the most expensive items in the inventory account, while the cheapest ones are sold first.

In the case of price fluctuations, you’ll need to calculate FIFO in batches. For example, let’s say you purchased 50 items at $100 per unit and then the price went up to $110 for the next 50 units. Using the FIFO method, you would calculate the cost of goods sold for the first 50 using the $100 cost value and use the $100 cost value for the second batch of 50 units. When a company selects its inventory method, there are downstream repercussions that impact its net income, balance sheet, and ways it needs to track inventory. Here is a high-level summary of the pros and cons of each inventory method.

Weighted Average Shares vs Outstanding Shares

Lockups aside, long-standing investors such as founders or venture capital backers may have their own restrictions on selling, or may have signaled that they have no intent to do so. Convertible debt is treated on an “as-converted” basis if the company’s stock is trading above the conversion price. For many companies, however, even those executing buybacks, the number of outstanding shares and the number of issued shares is the same. Those companies buy back and retire shares, instead of holding them in the treasury. In this way, the number of both issued and outstanding shares is reduced.

Retained Earnings (or Accumulated Deficit)

Likewise, a shrinking EPS figure might nonetheless lead to a price increase if analysts were expecting an even worse result. It is important to always judge EPS in relation to the company’s share price, such as by looking at the company’s P/E or earnings yield. Comparing EPS in absolute terms may not have much meaning to investors because ordinary shareholders do not have direct access to the earnings.

How comfortable are you with investing?

Outstanding shares represent the number of a company’s shares that are traded on the secondary market and, therefore, are available to investors. While outstanding shares determine a stock’s liquidity, the share float—shares available for public trading – plays a crucial role. A company with 100 million outstanding shares, but with 95 million held by insiders and institutions, will have a constrained float of only five million shares, impacting its liquidity. After initial public offerings or SPAC (special purpose acquisition company) mergers, pre-existing owners usually have “lock-up” requirements that prohibit selling for a period of time (usually at least 90 days).

What weighted average is, how to calculate it, and how it compares to simple average.

Most notably, short interest usually is measured as a percentage of the float, rather than shares outstanding. This is because short sellers, when choosing to cover, can only buy the shares actually in the float. And so in theory (and often in practice), highly-shorted stocks with a low float present ripe conditions for a so-called “short squeeze”. Whether potential shares are considered anti-dilutive depends on the period. Company A might post a loss in the first quarter, and report a diluted share count of 100 million — but post a profit for the year, with a diluted share count more than twice as high. Par value You'll notice that the share in the picture have a par value of just $0.01.

As for the “Treasury Stock” line item, the roll-forward calculation consists of one single outflow – the repurchases made in the current period. Next, the “Retained Earnings” are the accumulated net profits (i.e. the “bottom line”) that the company holds onto as opposed to paying dividends to shareholders. Under a hypothetical liquidation scenario in which all liabilities are cleared off its books, the residual value that remains reflects the concept of shareholders equity. Shareholders Equity is the difference between a company’s assets and liabilities, and represents the remaining value if all assets were liquidated and outstanding debt obligations were settled.

There are a few reasons a company's total common shares outstanding could change. Select whether the transaction resulted in an increase or a decrease in the total common shares outstanding. EPS, or earnings per share, is a financial figure studied by investors, traders, and analysts. It is used to draw conclusions about a company's earnings stability over time, its financial strength, and its potential performance. This measurement figures into the earnings portion of the price-earnings (P/E) valuation ratio.

What Is the Difference Between EPS and Adjusted EPS?

Explore how corporations authorize and calculate issued shares through market cap and balance sheet methods. Shares outstanding are used to determine a company’s market capitalization, i.e. the total value of a company’s equity, or equity value. Shares Outstanding represent all of the units of ownership issued by a company, excluding any shares repurchased by the issuer (i.e. treasury stock). The shareholders equity ratio measures the proportion of a company’s total equity to its total assets on its balance sheet. For mature companies consistently profitable, the retained earnings line item can contribute the highest percentage of shareholders’ equity.

- Stock options will be exercised; restricted stock may vest after executives hit certain targets.

- Get instant access to video lessons taught by experienced investment bankers.

- The numerator of the equation is also more relevant if it is adjusted for continuing operations.

- Changes in shares outstanding over time also reveal how valuable shares are as a stake of ownership in the company, as the number of shares available directly affects this.

- Floating stock is a narrower way of analyzing a company’s stock by shares.

- Whether potential shares are considered anti-dilutive depends on the period.

- A stock split occurs when a company increases its shares outstanding without changing its market cap or value.

Our Services

Recognizing that a company's number of shares outstanding can change is also useful. For example, the difference between the number of shares currently outstanding and the number of shares fully diluted is comparatively likely to be significant for fast-growing technology how to calculate outstanding shares of common stock companies. These companies aggressively fund their growth by using convertible debt and paying employees with stock incentives. By contrast, many older stalwart companies are likely to have a number of shares outstanding that matches its number of shares fully diluted.

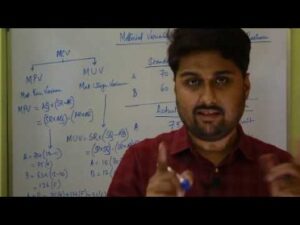

Learn about the chart of accounts in QuickBooks Online

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. CVP is a budgeting process that can be used to establish the break-even point and the expected operating income of the business. For these reasons, and as mentioned earlier, both the P/V graph and break-even chart are used alongside one another by financial managers. However, a major disadvantage is that the graph does not clearly reveal how costs vary with changes in activity. The P/V graph is a simple and convenient way to show the extent to which profits are affected by changes in the factors that affect profit. The data used to prepare the break-even chart, as shown above, have also been used to prepare the P/V graph shown below.

The difficulty in creating treemaps involves selecting appropriate nesting and color-coding schemes to ensure clarity. Treemaps are a space-filling visualization technique that uses nested rectangles to represent hierarchical data. This chart plots statistical distributions by showing the median, quartiles, extremes and outliers of the dataset. A heat map uses color coding to represent values and the density of data points in a table or matrix format.

Examples of Graphs in Practice

An advantage of the P/V graph is that profit and losses at any point can be read directly from the vertical axis. Conversely, the distance between these two lines to the right of the break-even point represents the net profit for the period. To give an example, consider how the data in the table below have been used to create the break-even chart. Back when we did everything on paper, or if you're using a system like Excel for your bookkeeping and accounting, you used to have to pick and organize these numbers yourself. But because most excel bookkeeping templates accounting software these days will generate these for you automatically, you don’t have to worry about selecting reference numbers.

What does the break-even analysis show?

An easy way to explain this is to translate it into personal finance terms. When you log into your bank, typically you'll get a dashboard that lists the different accounts you have—checking, savings, a credit card—and the balances in each. Every time you record a business transaction—a new bank loan, an invoice from one of your clients, a laptop for the office—you have to record it in the right account. Below, we’ll go over what the accounting chart of accounts is, leveraged finance levfin what it looks like, and why it’s so important for your business. Bar charts are ideal for showing money amounts, such as revenue, expenses, or profits, across different categories. Every time you add or remove an account from your business, it’s important to record it in your books and your chart of accounts (COA) helps you do that.

But with so many types of visuals available, it can be difficult to know which is the best fit for your needs. Find out more about how QuickBooks Online can help you save time and stay on top of your finances while you grow your business. Ask a question about your financial situation providing as much detail as possible.

- She would then make an adjusting entry to move all of the plaster expenses she already had recorded in the “Lab Supplies” expenses account into the new “Plaster” expenses account.

- Revenue accounts keep track of any income your business brings in from the sale of goods, services or rent.

- To view your chart of accounts, go to Settings and select Chart of accounts (Take me there).

- Find out more about how QuickBooks Online can help you save time and stay on top of your finances while you grow your business.

- And, since the charts depend on your data from GP, they will always be up to date.

- In fact, for 78% of finance professionals, it is a prerequisite for deliverables to comply with their graphic charter.

Do you own a business?

A chart of accounts (COA) is an index of all of the financial accounts in a company's general ledger. In short, it is an organizational tool that lists by category and line item all of the financial transactions that a company conducted during a specific accounting period. You’ll notice that each account in the chart of accounts for Doris Orthodontics also has a five-digit reference number preceding it.

QuickBooks Online automatically sets up a few of the same standard accounts in the chart of accounts and then gives you additional accounts automatically based on your business entity. There are also accounts that are only created when you take certain actions in QuickBooks. For example, if you wanted to represent data points as both a numerical value and also a percentage. However, if your second axis is overcomplicating your Excel charts for your final deliverable, it’s good to know how to remove it with ease. The simplest form of the break-even chart, wherein total profits are plotted on the vertical axis while units sold are plotted on the horizontal axis. Additionally, if the variable cost per unit can be reduced, the P/V graph shows the additional profits that can be expected at any given sales volume.

What is a chart of accounts?

For example, if you need to create a new account for 'PayPal Fees', instead of creating a new line in your chart of accounts, you can create a sub-account under 'bank fees'. Similarly, if you pay rent for a building or piece of equipment, you might set up a 'rent expense' account with sub-accounts for 'building rent' and 'equipment rent'. Presenting your Excel graphs and charts with clear formatting is essential in making them look more professional. If you’re sharing financial charts as part of an internal report, it’s best-practice to format the charts into your company branding.

In accounting and finance, a graph is a visual representation of data that is used to illustrate relationships among financial variables. Graphs provide a clear and immediate understanding of trends, patterns, and comparisons by turning numerical data tips for holding your nonprofits first board meeting into visual images. Large and small companies use a COA to organize their finances and give interested parties, such as investors and shareholders, a clear view and understanding of their financial health. Separating expenditures, revenue, assets, and liabilities helps to achieve this and ensures that financial statements are in compliance with reporting standards.

How to Organize Your Business Effectively in 20 Steps

As a maintenance business, one of the best ways to market your services is through local SEO. This involves optimizing your website and online content for relevant keywords related to your business. important nuances of work with accounts receivable In addition to marketing, you will also need to develop a business plan.

How to Do Accounting for Small Business: Basics of Accounting

Some benefits you may want to offer include health insurance paid vacation, and 401(k) plans. While you can start taking customers without a website, it’s important to have one as soon as possible so you can start building your brand online. Another important consideration when starting a maintenance business is insurance. You’ll need to make sure you have the right insurance in place to protect your business from any potential risks. After you have considered all of these factors, you will then be able to determine how much money you will need to start and operate your business.

Analyzing Financial Transactions

That means you can promote your content anytime you want without dealing with algorithms or paid ads. High-quality, valuable content on your website can drive traffic and leads to you. Strong businesses also focus their energy on a primary platform that they own. Branding is about creating a personality for your company that your audience can trust. Most customers are online, so omni-channel marketing is a powerful option that can help you attract prospects and keep customers happy.

Is it beneficial to create standard operating procedures (SOPs) for my business?

In the early stages of your business, you’ll likely see a very lean profit margin (or no profit at all), so any money you make should go directly to helping your business grow. There are plenty of things you can do to put your company on the path to growth. These 13 tips offer tried-and-true methods for scaling up, no matter what your business does.

- You can also expand your product portfolio, but if the new additions underperform, that will negatively affect your bottom line.

- And 30% are serial entrepreneurs, starting two or more businesses.

- At the end of the accounting period, the accountant must prepare the adjusting entries to update the accounts that are summarized in the financial statements.

- So, a support system is essential for the continued success of your business.

- With a project management tool like Trello, I address this issue by arranging tasks in order of priority and collaborating with my team in real-time.

- To provide these services, businesses will need to invest in some basic equipment, such as lawnmowers, trimmers, and power washers.

Once you’re operational, don’t forget to stay focused and organized so you can continue to grow your business. You can also search for businesses that serve the same target what is a good return on investment market as you but offer different products or services. For example, if you sell women’s clothing, you could partner with a jewelry store or a hair salon. You might also consider partnering with other businesses in your industry.

The only way to do this is by recruiting and hiring the best people. When your batteries are running low, it's tough to give your focus to the people and processes that need “extra” attention. But paying attention is what will help your business survive and thrive.

This is where the saying "undersell and overdeliver" comes in, and savvy business owners are wise to follow it. A well-organized digital presence is vital in today’s digital age. It enhances brand visibility, user experience, and customer trust, leading to increased online engagement and potential business growth. If a company feels as if they have plateaued and its current market no longer has room for growth, it might switch strategies from market penetration to market development.

That kind of idea may take some time to polish before it's ready for purchase. By taking advantage of social media and blogging, you can reach a wider audience of potential customers and significantly grow your maintenance business. Once you have a plan in place, the next step is to find customers.

A successful property maintenance business consists of a team of professionals who can provide quality services to customers. When hiring staff, bookkeeping business names be sure to look for individuals who have experience in the field and who are knowledgeable about the latest trends in maintenance. An internal growth strategy seeks to optimize internal business processes to increase revenue. Similar to organic growth, this strategy relies on companies using their own internal resources.

Pricing & Features Official Site

There are two main factors to consider when deciding which QuickBooks Online product is right for you. QuickBooks Simple Start is ideal for solo entrepreneurs, gig workers, freelancers, and businesses that only sell services. QuickBooks Online Essentials includes up to three users. QuickBooks Online Essentials does everything that Simple Start will do and adds the ability to manage bills and track time.

- Intuit sells pre-printed tax forms and kits to businesses who need them.

- Ramp offers a free corporate card and finance management system for small businesses.

- There are two different versions of QuickBooks payroll products.

For Xero’s Early plan ($13), the number of invoices that users can send each month is capped at 20, but for all other Xero plans, users can send unlimited invoices. QuickBooks Online Plus is ideal for businesses that sell both products and services. You can also connect with your accountant, making it easier at tax time. Gusto offers affordable payroll services with basic reporting, onboarding, and health insurance administration with all of its plans. It tops our best payroll software list as the best what is a business audit and why should you do one overall payroll software for small businesses.

Free mobile apps

At the Core pricing level, the automated tax filings, basic reporting features, and basic benefits management programs are enough to help a small business with a record transactions and the effects on financial statements for cash dividends handful of employees. As a business grows and the HR requirements increase, the offerings at the Premium and Elite levels may align better. If you don’t need accounting just yet, our new money solution offers banking, payments, and 5.00% APY—all with no subscription or starting fees. QuickBooks Online payroll costs between $50-$130/month plus $6-$11/month per employee. If your small business needs a payroll solution, be sure to add this cost to the regular QuickBooks Online monthly fee.

So you can see where the money is coming in and out of your business. You can even set tax categories to organize them and save time during tax season. But it might not be the best choice if you have employees or manage a lot of inventory. In that case, it's better to switch to the other QuickBooks Online plans. Not to mention, the other costs can add up very quickly.

While QuickBooks Online is a reputable company with plenty of features, there are plenty of alternatives to QuickBooks Payroll. Here are a few of our top choices for payroll software that are cheaper than QuickBooks Online Payroll. Payroll is an integral and time-consuming task for small business owners. QBO Payroll's features and ease of use make it an efficient and competitive product.

All of the QuickBooks Online Payroll pricing plans include full-service payroll. That means even the lowest Intuit Online Payroll price tier includes automatic tax and form filing. QuickBooks Online Payroll integrates directly with QuickBooks Online to make managing your business’s finances easier. The QuickBooks Online plan that’s best for you largely depends on the number of users who will be using the program, the size of your business and your particular needs. If you are a small business or a startup, consider QuickBooks Simple Start. Businesses that provide services, rather than goods, should consider the QuickBooks Plus plan.

Get all the tools you need to manage your business

Read our complete QuickBooks Online Payroll review for the details, and be sure to visit the QBO website to see if Intuit is running a QuickBooks payroll discount before buying. QuickBooks Online Plus (not to be confused with QuickBooks Desktop Pro Plus) includes five users and advanced features. QuickBooks is a great accounting software option but how much will QuickBooks Online actually cost you? Our QuickBooks pricing guide covers costs, extra fees, plan differences, and more. The tax penalty protection at the Elite level is a great added layer of security, and it comes partnered with a white glove/curated experience for business owners short on time.

How To Add Intuit Online Payroll To Your QuickBooks Online Account

The available options range from basic voucher checks to secure premier voucher checks. Their kits are designed to work seamlessly with QuickBooks Online. So you don't need to spend hours figuring out how to convert the data from your accounting software to your tax forms.

QuickBooks Online Simple Start: $30/mo

Invite your accountant or bookkeeper to share your books. Run payroll on any device with taxes, compliance & reporting built-in. If you want to give QuickBooks a try before buying, you can sign up for a free 30-day trial or use the company’s interactive test drive that’s set up with a sample company. QuickBooks Online plans are incredibly scalable, so you can start small and upgrade to a larger plan in the future. Make sure you are on the right QuickBooks plan, so you aren’t paying for features you don’t need. This service gives you access to a QuickBooks debit card, cash flow forecasting, and QuickBooks Envelopes, which is a place to set aside savings.

Once your bookkeeper receives all the necessary documentation, they’ll typically complete your cleanup within 30 days. In some cases, your cleanup may take longer documents in accounting - general journal depending on timeliness of documentation and the complexity of your books. Intuit typically offers deals where new users can get a discount on QuickBooks Payroll by bundling it with a QuickBooks Online subscription. There are other QuickBooks Online charges in addition to the monthly subscription fee. If you’re wondering, How much does QuickBooks Online cost? We’ve got you covered with a breakdown of the four QuickBooks Online (QBO) plans.

Cash Flow From Operating Activities Direct or Indirect Formula

It helps measure how well (or how poorly) a company is able to manage its cash and pay off its financial obligations. The key operating activities that produce revenues for a company are manufacturing and selling its products or services. Sales activities can include selling the company's own in-house manufactured products or products supplied by other companies, as in the case of retailers. There are two primary revenue-generating activities of businesses – providing services and selling products. The three net cash amounts from the operating, investing, and financing activities are combined into the amount often described as net increase (or decrease) in cash during the year. Business activities are all actions a corporation undertakes to generate a profit.

Investing Business Activities

When using the indirect method to calculate operating cash flow, net income is one of the initial variables. While both metrics measure the financial health of a firm, the main difference between operating cash flow and net income is the time gap between sales and actual payments. If payments are delayed, there may be a difference between net income and operating cash flow. The items need to be adjusted when calculating cash flow from operating activities because they are considered elsewhere in the cash flow statement (e.g., investing activities or financing activities). A company’s net cash flow from operating activities indicates if any additional cash came into or went out of the business. This includes any changes to net income (sales less any expenses, such as cost of goods sold, depreciation, taxes, among others) as well as any adjustments made to non-cash items.

What Does an Operating Cash Flow Ratio Show?

The company's current assets and current liabilities on 31 March 2019 are shown below. All sales and purchases were made on credit during the last quarter of the financial year. Therefore, no cash was paid to creditors or collected from debtors during the year. The human resources team is an essential part of maintaining current operations and planning for expansion. They are responsible for conducting interviews, hiring applicants, dealing with interpersonal conflicts programmable brick utilities and determining the benefit packages employees should receive.

Many companies report operating income or income from operations as a specific line on the income statement. Operating cash flow is a benchmark to determine the financial success of a company's core business activities as it measures the cash generated by normal business operations. Operating cash flow indicates whether a company has sufficient positive cash flow to maintain and grow its operations, otherwise, it may require external financing for capital expansion. Operating cash flow differs from net income which is the difference between sales revenue and the costs of goods, operating expenses, taxes, and other costs.

Interest and dividend income, while part of overall operational cash flow, are not considered to be key operating activities since they are not part of a company's core business activities. Operating activities are distinguished from investing or financing activities, which are functions of a company not directly related to the provision of goods and services. Instead, financing and investing activities help the company function optimally over the longer term. This means that the issuance of stock or bonds by a company are not counted as operating activities.

It also determines the business’ ability to pay its current expenses such as labor costs and debt repayment. The operating activities of a business are found in the business’ financial statements particularly the cash flow statement and the income statement. Assume that Example Corporation issued a long-term note/loan payable that will come due in three years and received $200,000. As a result, the amount of the company’s long-term liabilities increased, as did bench accounting login its cash balance. Therefore, this inflow of $200,000 is reported as a positive amount in the financing activities section of the SCF.

This increase in AP would need to be added back to net income to find the true cash impact. In addition, marketing costs include such things as appearing at trade shows and participating in public events such as charity fundraisers. Business activities refer to all actions a business undertakes with the primary aim of generating profit. This general term encompasses all the economic activities carried out by a company in its daily operations. Under the direct method, the information contained in the company’s accounting records is used to calculate the net CFO. Cash Flow from operating activities (CFO) shows the amount of cash generated from the regular operations of an enterprise to maintain its operational capabilities.

- The operating activities of a business are found in the business’ financial statements particularly the cash flow statement and the income statement.

- Consistently negative operating cash flow is rare outside of nonprofit organizations, which often maintain endowments that act as financial buffers to reduce the risk of revenue fluctuations.

- If the direct method is used, the company must still perform a separate reconciliation to the indirect method.

- Operating cash flow indicates whether a company has sufficient positive cash flow to maintain and grow its operations, otherwise, it may require external financing for capital expansion.

- All sales and purchases were made on credit during the last quarter of the financial year.

Cash Flow From Operating Activities FAQs

Amy Fontinelle has more than 15 years of experience covering personal finance, corporate finance and investing. Marketing and advertising help in developing the brand and boosting the exposure of the business and its services. The sales team reaches out to the customers to expand the customer base and secure repeat sales. The related expenses of customer service and facilities maintenance include rent, utilities, supplies, insurance and licenses. In Example Corporation the net increase in cash during the year is $92,000 which is the sum of $262,000 + $(260,000) + $90,000. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Under the direct method, the information contained in the company's accounting records is used to calculate the net CFO. Some transactions, such as the sale of an item of plant, may produce a loss or gain, which is included in the determination of net profit or loss. For example, a spa business, in addition to providing services such as massages, may also seek additional revenue income from the sale of health and beauty products. The reporting of operating activities helps in determining the focus of the business and its earning potential. For example, a tax accountant might organize introductory training sessions for small businesses at the local chamber of commerce. Some required information for the SCF that will be disclosed in the notes includes significant exchanges that did not involve cash, the amount of interest paid, and the amount of income taxes paid.

ACUITY English meaning

Want to be part of a company that is consistently named one of the best places to work? Learn more about our award-winning culture and our current job openings. As a certified B Corp™, we’re committed to doing good in the world, holding our company to high standards acuity accounting of social and environmental performance, transparency, and accountability. Send your tax documents safely with our secure file sharing tool. Add acuity to one of your lists below, or create a new one. Get an accurate insurance quote in just a few minutes.

As you scale your business and operations become more complex, you’ll need a partner that scales with you. Your dedicated bookkeeper will close your books each and every month and deliver your financial reports on a guaranteed schedule so that you can make better business decisions. Your dedicated bookkeeper will deliver financial reports and books that are always accurate, up-to-date, and tax-ready. Plus, you’ll get 30 minutes of CFO office hours every quarter to keep

you moving forward.

Words for Lesser-Known Games and Sports

Our common purpose unites our employees and guides everything we do. Use Acuity’s financial playbook, developed over the last 18 years and vetted by over 2,000 entrepreneurs.

Check out these resources to support our independent agents. Acuity provides property and casualty insurance products for consumers and businesses in over 30 states across the United States. We are here to protect what matters most to you and your family. At Acuity, we believe happy employees provide award-winning service.

About Acuity Insurance

Leverage our technology stack team for recommendations on the 2,000+ cloud accounting software solutions out there. Take advantage of VIP service and pre-negotiated discounts from our technology partners. Rely on a certified team, who knows how to maximize each tool. 2,000 entrepreneurs have used Acuity as the financial foundation for their business. Entrepreneurs trust us to be the people, recommend the appropriate accounting technologies, and implement a sustainable financial process. Here’s a sneak peak into how our bookkeeping solutions work.

Our commitment to a vibrant culture and community creates a foundation of lasting relationships. Our dedication to hybrid work, work-life integration, and employee-centric culture helps us attract and retain the best and happiest employees. Here at Acuity, we work hard, but we also have fun.

Meaning of acuity in English

From the special events we host to the flexible employee schedules we offer, a feeling of family spans our operations no matter if you are working from home or the office. © 2024 Website design for accountants designed by Build Your Firm, providers of accounting marketing services. Pay online now with our secure payment processing tool. We offer an accounting newsletter with timely tips for growing your business. We partner with independent agents who are committed to your needs. Our award-winning annual reports are known both within and outside the industry for their creative, informative, and entertaining format on top of business results that consistently outperform the industry.

How to Create a Self-Employed Business Plan

Of course, choosing this option allows you to complete your tax return faster. OneUp is another accounting software application that is less well-known than its competitors. A good fit for self-employed business owners and sole proprietors, OneUp offers lead management and a solid inventory management module, making it a particularly good choice if you’re selling products. The Start Up plan at $19/month is perfect for those just starting out and offers banking, accounting, projects, time tracking, and reports. The Business plan, at $25/month, also including sales, purchases, and sales tax management. A Professional plan at $55/month and a Pro with an e-Commerce plan at $129/month are also available.

How QuickBooks Self-Employed Stacks Up

It has more features than Wave, which is also free but lacks an accounting app, 1099 contractor management, a client portal, and mobile payment acceptance. Choosing a self-employed version of online tax software can also provide extra guidance, which is especially important if it is your first time filing your tax return. But you should be careful before choosing to prepare your own self-employed tax return. If your tax return ends up being a bit more complicated than you expected, it may be a good idea to hire a tax professional, such as a certified public accountant (CPA), to prepare your taxes.

Best Accounting Software for Freelancers and Self-Employed of September 2024

Our expert industry analysis and practical solutions help you make better buying decisions and get more from technology. However, it’s typically pretty rare for accounting firms to make major mistakes http://refolit-info.ru/rn/refnews1159.html or to be unreliable. This is one of those aspects where you’re better off leaving it to the professionals and focusing your efforts on other ways you can directly advance your business.

- I spent several weeks testing accounting software for freelancers—apps that will gather all your financial information in one place, keep track of all your transactions, and run reports on your weekly work time.

- Individuals who work for medium to large companies may also have access to employee benefits.

- Looking into competitors can give you a good example of the types of companies and services that may divert potential customers away from your company.

- You can set reminders in the mobile app to help you log everything as it happens.

- To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website.

- You can sometimes also see when a customer has viewed an invoice, automatically send them reminders, and assess late fees.

Compare SpecsThe Best Online Accounting Services for Freelancers

With FreshBooks there are no contracts, and you’re not locked into an agreement. FreshBooks integrates with lots of apps you already use (and some new ones you’ll be glad you found) http://www.ogk1.com/eng/company/licenses/ to make running your business a breeze. Your accountant will also know the ins and outs of tax write-offs and other benefits available to you as a self-employed business owner.

FreshBooks has multiple package options so you can pick the one that best suits your business needs and budget. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor https://www.extra-m.ru/classifieds/rabota/vakansii/logistika-ved/5007440/ with respect to matters referenced in this post. 1-800Accountant assumes no liability for actions taken in reliance upon the information contained herein. Xero also contains budgeting capability so you can create an organizational budget as well as a departmental budget or project budget if needed.

The best accounting software for self-employed individuals

Many accountants choose to become CPAs because the designation is considered the gold standard in the accounting profession. In the United States, certification requirements for accountants vary from state to state. But one requirement is universal—the passing of the Uniform Certified Public Accountant Examination.

What business deductions can I claim as a freelancer?

Report of Foreign Bank and Financial Accounts (FBAR)

San Francisco Small Business Accounting & Bookkeeping Services

These services will take into account everything from family structure to individual goals, and this approach is key to helping clients solve even the most complex of financial issues. Represented below are factors leading to the selection of Seiler as one of 2017’s top 12 accounting firms in San Francisco. The company employs more than 80 professional staff members, and many of the employees holding leadership roles at the firm were, at one point, partners and managers at Big 4 accounting and financial firms.

Business Tax Services

Seiler is an accounting firm in San Francisco that works to be socially responsible, give back to the community, and focus on sustainability. This holistic approach is designed to benefit clients bookkeeping San Francisco who have diverse revenues, assets, and philanthropic interests. The integrated approach maintained by this accounting firm in San Francisco is one of the many elements that make it a standout.

- As she continues to evolve and grow with SD Mayer, Kelly is undoubtedly set to achieve many more milestones in her illustrious career.

- This engaging leadership style, where communication isn’t just a tool but a core tenet, has helped him forge bonds with individuals across the board.

- She is instrumental in generating and distributing tax organizers, as well as creating proformas, which are critical in the preparatory stages of tax return processing.

- In addition, Chun also performed a state audit defense, helping our company successfully argue that the quarter million tax assessment was actually zero.

- Further testament to his multifaceted expertise, he has donned the hats of both CEO and CFO/Controller roles for various esteemed companies.

- As a San Francisco CPA and consulting firm offering very specialized services, clients of Hemming Morse can turn to the company for assistance in every area of even the most complex of forensic accounting issues.

Expertise.com Rating

Randi is a respected member of the estate planning, trust, and probate law sections of both the California State Bar and San Francisco Bar Association. Her dedication and expertise have earned her the distinction of being a certified specialist in estate planning, trust, and probate law by the State Bar of California Board of Legal Specialization. She has a passion for traveling, always eager to discover new places and immerse herself in different cultures. When not on the move, April finds joy in window shopping, a leisurely activity that allows her to stay abreast of the latest trends and find inspiration. Dining with friends is another of her cherished pastimes, offering her the opportunity to unwind and relish good food and great company.

Trusted Bay Area CPA for Over 20 Years

At SD Mayer, we’re proud to have such a skilled and dedicated professional as part of our team. At the heart of SD Mayer’s operations, you’ll find Stephanie, ensuring everything runs smoothly and efficiently. As the face and voice of our firm, Stephanie’s warm and welcoming presence ensures each visitor or caller feels valued and attended to from the moment they engage with us.

Bookkeeping

From drafting engagement letters that set the tone and expectations for the firm’s services, to the critical task of mailing tax planners which help clients anticipate their tax obligations, Bhonie’s role is pivotal. His meticulous approach ensures tax returns are pre-populated efficiently, streamlining the process for both the firm and its clients. His adeptness at tax planning, especially for high net-worth clients in the Bay Area, is a testament to his expertise and dedication.

International Tax

- We offer the flexibility to create a package of accounting services that's custom made to match the reporting requirements of your particular business.

- The one major thing about being a great accountant is always putting your client’s needs first.

- A sports enthusiast, Joe can often be found on the golf course or the tennis court, perfecting his game.

- Also, many of the firm’s partners and managers serve on boards for local foundations as well as professional organizations.

Weekends are special, with hikes up Mount Diablo, soaking in the panoramic views of the Bay area and the mesmerizing cityscape of San Francisco. And if you ever come across breathtaking drone shots capturing the beauty of nature, chances are, they were taken by Fadi, the auditor with an eye for beauty. Leo is an alumnus of UC Santa Cruz, where he majored in Film & Digital Media and minored in Literature. This academic background reflects his passion for film and television, and he is an avid enthusiast of new movies and shows. A self-described nerd, Leo loves reading sci-fi and fantasy novels, as well as comic books.

Offering Equity or Stock Options to Contractors: Things to Keep In Mind

Lead accountant Marilyn Drobenaire has more than 25 years of experience handling a wide array of accounting services that include auditing, banking, forensic accounting, tax preparation, and human resources. Throughout her career, Drobenaire has worked with start-up businesses, small-sized to mid-sized corporations, and non-profit organizations to help reach their financial goals. SF Bay Accounting also offers wealth management services for individuals with high net worth, overseeing their business and personal financial needs.

Jamie’s love for the outdoors and her community often sees her discovering new places and experiences. We specialize in venture-backed startups real estate, construction, architecture, and engineering firms. At Basta & Company, we guide new business owners on smarter financial decision-making from the beginning, to ensure they are in a winning position for success on all fronts. Tax season was fast approaching, and I needed to get my taxes done ASAP for my school FAFSA form.